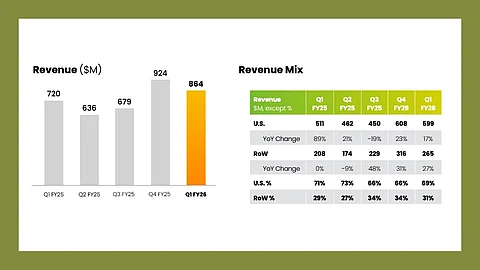

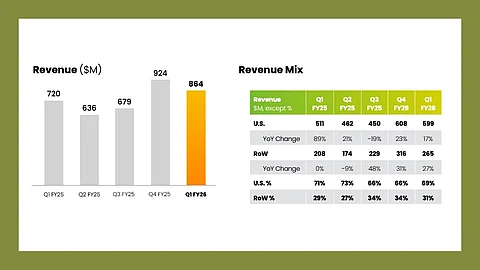

Nextracker's Q1 FY26 revenue rose 20% YoY to $864 million, with 27% growth from international markets

Gross profit rose 19% YoY to $282 million; project backlog reached $4.75B, boosted by IRA credits

With $40 million in 3 new technology acquisitions, Nextracker has launched an AI-robotics arm to enhance solar plant intelligence

Nextracker, one of the leading solar tracker suppliers globally, reported a 20% year-over-year (YoY) increase in Q1 FY2026 revenues to $864 million, driven largely by overseas markets. However, international revenue growth moderated to 27%, down from 31% in the previous quarter.

The US market accounted for close to 69% of its geographic revenue mix, while 31% came from the rest of the world, compared with 71% and 29%, respectively, in Q1 FY25. Nextracker was the largest solar tracker supplier in 2024 for the 10th consecutive year, according to Wood Mackenzie, which said that the company expanded its presence in every major region last year (see 2024 Global Solar Tracker Shipments Up 20% to 111 GW DC).

It has also reported a 19% YoY increase in GAAP gross profit at $282 million and 16% in GAAP operating income of $186 million. The management attributed the growth to disciplined execution and ongoing investment in high-value technologies.

The quarterly results also include close to $93 million of Inflation Reduction Act (IRA) Section 45X advanced manufacturing tax credit vendor rebates. Nextracker remains buoyant about the US solar industry growth while awaiting further clarity from the Department of the Treasury on safe harbor rules. Meanwhile, it says its project backlog has expanded to $4.75 billion.

For FY26, the management has slightly raised its guidance, now expecting revenues to be in the range of $3.2 billion to $3.45 billion, while the adjusted EBITDA is expected to range within $750 million and $810 million. GAAP net income is now projected to fall within $496 million to $543 million, compared to $445 million to $503 million it announced previously (see Nextracker Sees 18% YoY Revenue Growth In FY2025).

Nextracker said this revised forecast assumes the current US policy environment to continue and that permitting processes and timelines will remain consistent with historical levels.

“We are closely monitoring potential updates to safe harbor provisions and other regulatory actions, which could impact project timing, investment decisions, and our financial results,” it added.

Nextracker has also launched a new AI and robotics initiative. Over the past year, the company has invested over $40 million in acquiring 3 AI and robotics technologies to strengthen its digital platform and improve solar plant deployment, quality, reliability, and returns for asset owners. This includes autonomous robotic inspection and fire detection systems for solar power plants provider OnSight Technology; SenseHawk IP, which can create high-resolution 3D as-built maps of solar project sites using AI-enabled drone-captured imagery; and Amir Robotics, which has developed a lightweight, water-free robotic cleaning technology for large-scale solar sites.

As the Chief AI and Robotics Officer of the new AI entity, Dr. Francesco Borrelli, an expert in predictive control systems, will lead efforts to integrate AI, machine learning, and robotics into Nextracker’s offerings. With around 100 GW of systems deployed globally, Nextracker says it aims to use these technologies to scale innovation and deliver smarter, more efficient solutions for its customers.