JA Solar attributes its net loss in H1 2024 to intensive industry fluctuations

Its total module shipments of 38 GW were driven by the overseas markets

Apart from the big 3 markets of China, Europe and the US, JA is also actively expanding into other markets

Vertically integrated solar PV manufacturer JA Solar was in the red during H1 2024 as it reported a net loss of RMB 874.20 million ($123.52 million) for which it blames the intensified fluctuations in the industry and continuous decline in product prices. This was a year-on-year (YoY) decline of 118.16%.

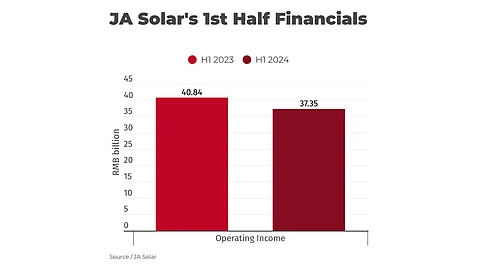

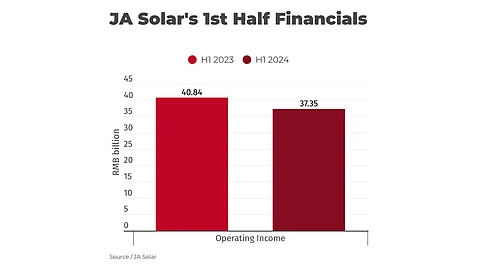

Its operating income too dropped by 8.54% YoY to RMB 37.35 billion ($5.24 billion).

However, the management focused on its global marketing service network and brand advantages during the 1st half of 2024 to report 38 GW in solar module shipments, including 1 GW for self-use. Overseas module shipments accounted for about 54% share.

During this time, it concentrated on upgrading the technology and performance of the DeepBlue 4.0 Pro range and released several new products, including for offshore use, 0BB module solutions, and single-glass anti-dust modules based on its proprietary Bycium+ cell technology.

JA said that it invested RMB 1.959 billion in R&D during H1, accounting for 5.24% of its operating income. At the end of the reporting period, JA had 1,827 valid patents, including 977 invention patents, according to its financial report.

Currently, the manufacturer touts a mass production efficiency of 26.5% for its latest n-type Bycium+ cell. It plans to continue to improve the technology to further reduce the cell production cost.

According to its manufacturing capacity roadmap, by the end of 2024, JA Solar targets to exceed an annual production capacity of 100 GW for solar modules with that of silicon wafer and cell capacity reaching 80% of the module capacity, including 57 GW of n-type cell capacity.

Going forward, JA said it is keeping a close eye on the major mature photovoltaic markets such as China, Europe and the United States. At the same time, it is actively expanding into emerging markets such as Southeast Australia, Latin America, the Middle East and Africa.

At this year’s SNEC 2024 in Shanghai, China, JA Solar showcased its latest application-specific TOPCon module series and all-in-one hybrid storage systems to TaiyangNews (see JA Solar’s Application-Specific N-TOPCon Module Series At SNEC).