As more protectionist measures are expected to be rolled in, the US solar industry is likely to have a very expensive supply chain in the future

High labor costs and lack of economies of scale compared to its counterparts in China and elsewhere will contribute to this factor

More protectionist measures can certainly be expected under a Donald Trump presidency

While growth in domestic manufacturing capacity is certain, it will be a more expensive market for domestic buyers

A new analysis from Wood Mackenzie claims that while new trade tariffs and increased import restrictions in the US solar supply chain would expand domestic manufacturing, these may lead to constrained access to international suppliers leading to a more expensive solar supply chain market for the country.

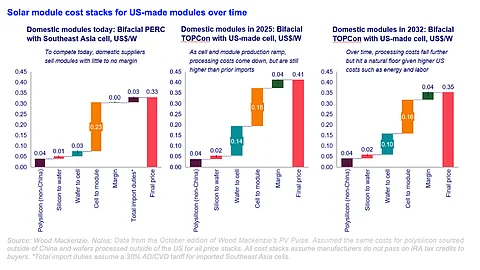

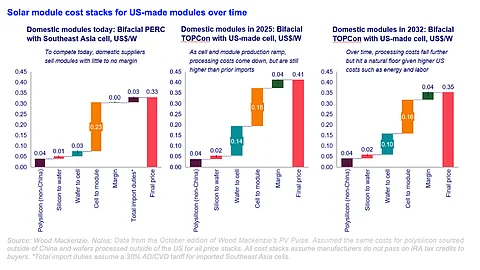

At present, the cell-to-module processing costs stand at $0.23/W, leading to about $0.33/W as the final price for a US-made bifacial PERC module using cells supplied from Southeast Asia.

As the US builds its own cell capacity, in 2025, a bifacial TOPCon module with US-made cells will have $0.18/W of cell-to-module processing cost, and a final price of $0.41/W.

In 2032, as cell-to-module processing cost further drops to $0.16/W with more domestic capacity, a bifacial TOPCon module from the US will still cost $0.35/W. Solar module makers will then continue to sell modules with little to no margin in 2032 ($0.04/W) which at present is $0.03/W.

Analysts share, “Early anecdotal data on US-made cell prices puts them around $0.20 - $0.25/watt – we’d expect that to decline to $0.17/watt by 2032. However, these prices are still notably higher than imports from other regions.”

The cell-to-module processing costs in Southeast Asia are about $0.07 to $0.08/W, while the cells made here are about $0.08/W, not including the potential new AD/CVD tariffs. Even if the US were to enact new tariffs, Wood Mackenzie believes cell pricing from other countries not subject to the tariffs such as Indonesia and Laos is around $0.10/W.

In its new report titled The US solar supply chain under more protectionism, Wood Mackenzie expects more protectionist measures from the US in response to the significant drop in component pricing in the last year.

“Our analysis shows that if the US enacts more protectionist measures that ultimately limit solar imports, it will likely increase domestic solar supply chain growth. But it will also cause market havoc, increase equipment prices, and potentially delay, if not jeopardize, solar project viability. This would simply further delay progress on the nation’s stated decarbonization targets,” according to the analysts.

The factors that are likely to contribute to expensive US-made solar equipment are:

high labor costs driven by apprenticeship and diversity requirements, local hiring, shorter work shifts and higher staff turnover in the US compared to other countries, and

the US is a long way from achieving the economies of scale enjoyed by the leading solar manufacturing regions.

Saying that many in the solar industry expect more trade actions in the future as domestic manufacturers lobby for the same, and anti-China sentiment grows in US politics, Wood Mackenzie’s Director and Head of Global Solar, Michelle Davis says, “Finally, the upcoming presidential election presents further uncertainty. It’s impossible to predict the policies that either administration would enact, and both have supported protectionist trade actions in the past, but a Trump administration would be a wildcard for the industry -- proposing tariffs of 60% on all imports from China.”

In a supply-constrained future, the report writers forecast the US to have 11 GW of wafer, 55 GW of cell, and 88 GW of module manufacturing capacity. Nevertheless, according to the announcements made, the US wafer manufacturing capacity is likely to grow from around nothing in 2023 to 22 GW in 2027, cell capacity to 74 GW, and module capacity from 18 GW in 2023 to 139 GW in 2027.

In such a supply-constrained future, expensive modules with domestic content will still make sense for buyers, according to Wood Mackenzie, but they would need to adapt their procurement strategies.

“Most suppliers prefer to work directly with buyers on large, repeat deals. Conversations with domestic manufacturers indicate they would favor these direct relationships with buyers and deprioritize their other routes to market, particularly participation in bidding processes. Buyers with strong direct relationships would get better access to equipment and more favorable terms compared to newer, less familiar buyers. Such circumstances will increase the strategic importance of these relationships,” reads the report.

The complete report can be purchased from Wood Mackenzie’s website for $3,000.