ReNew Energy’s Q3 FY26 revenue rose 36% YoY to INR 25.1 billion, while net loss narrowed sharply to INR 198 million

Power generation contributed INR 19.2 billion, supported by a 23.1% YoY rise in electricity sales to 5,077 million kWh, mainly from solar and wind assets

ReNew is reducing wind exposure and adding more solar and BESS to lower execution risk and improve cash flow predictability

Increase in the sale of power and that of solar cells and modules helped Nasdaq-listed ReNew Energy Global Plc improve its total revenue for Q3 FY2026 (ended December 31, 2025) by 36% year-on-year (YoY) to INR 25.1 billion. Its net loss for the reporting quarter narrowed to INR 198 million from INR 3,879 million in Q3 FY2025.

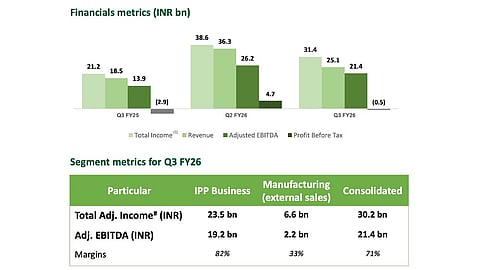

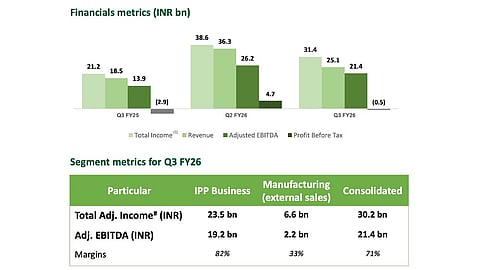

Its adjusted EBITDA for the period, at INR 21.4 billion, was up 54% YoY. The independent power producer (IPP) business brought in INR 19.2 billion to the total, while external sales by its manufacturing wing contributed INR 2.2 billion.

Nevertheless, total revenue and adjusted EBITDA were a decline compared to INR 36.3 billion and INR 26.2 billion reported in the previous quarter, respectively (see ReNew Improves H1 FY26 Revenues; Bags ADB Financing For Hybrid Project).

ReNew sold 23.1% more electricity from its power plants on a YoY basis. Of the total 5,077 million kWh, it sold 2,812 million kWh of solar, 2,178 million kWh of wind, and 87 million kWh from the hydro assets.

In a strategic move, ReNew Founder Chairman and CEO Sumant Sinha shared the decision to replace part of its wind projects with more battery energy storage systems (BESS) and solar for complex projects in line with its strategy to focus on optimizing its portfolio for lower execution risk, CapEx, and more predictable cash flows.

Wind’s share from its committed capacity has, therefore, been lowered from 2.5 GW to around 850 MW. At the end of the reporting period, its total renewable energy portfolio stood at 19.2 GW, including 6 GW of solar and 1.5 GW of BESS, from 17.4 GW as of December 31, 2024.

Claiming one of the largest C&I portfolios in the country, ReNew said 50% of its portfolio is with leading technology companies. It will also focus on energy management services and renewable energy supply to data centers.

On the company’s earnings call, Sinha also shared that the company has secured connectivity for its entire portfolio, including for letter of awards (LOAs), with 5 GW to 6 GW of spare connectivity on hand.

ReNew, a solar PV manufacturer, says its module manufacturing capacity now produces 12 MW/day while cell capacity rolls out over 5.5 MW/day. The manufacturer claims that around 55% of its production capacity is sold externally. Its total external order book as of the end of December 2025 stood at 900 MW.

In 9M FY26, ReNew produced around 3 GW of solar modules and 1.4 GW of cells, including 1.02 GW and 463 MW in Q3, respectively. The total adjusted EBITDA for the manufacturing segment was INR 10.8 billion.

For FY26, ReNew guides for an adjusted EBITDA of INR 90 billion to INR 93 billion, comprising INR 11 billion to INR 13 billion from its manufacturing business. It also targets annual installations of 1.8 GW to 2.4 GW by March 31, 2026.

In December 2025, the proposed acquisition bid for the company by an international consortium, comprising Sumant Sinha, fell through after Masdar exited the consortium (see Masdar Pulls Out Of Proposed ReNew Energy Global Acquisition).