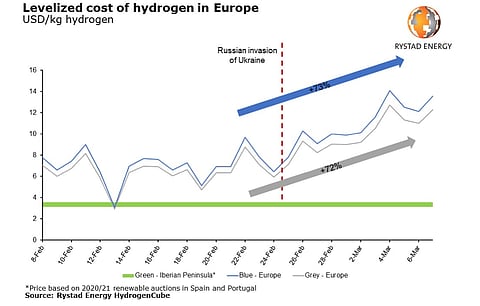

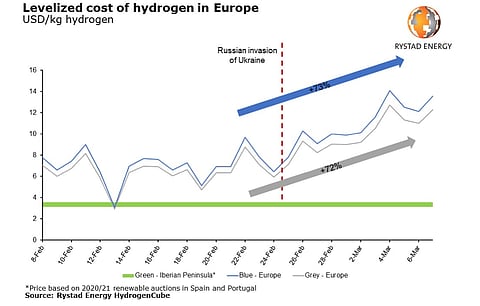

Green hydrogen production costs in Europe, especially in the Iberian Peninsula have come down to $4.00 per kg since the Russian invasion of Ukraine, while fossil-fuel linked blue hydrogen now costs $14.00 per kg and gray hydrogen $12.00 per kg, according to analysts at Rystad Energy.

"Green hydrogen's potential win comes at the expense of its fossil fuel-linked blue and gray alternatives, whose costs have increased by over 70% since the start of the war in Ukraine, rising from about $8/kg to$12/kg in a matter of days," said the analysts.

As Europe does the balancing act of overcoming its reliance on Russian energy imports, while focusing on becoming self-reliant in energy production via renewables, green hydrogen production has been 'turbocharged'.

Regulatory and financial support has been ensured with the European Union (EU) announcing a €300 million funding package for hydrogen and its Hydrogen Accelerator Initiative under REPowerEU (see EU's REPowerEU To Reduce Russia Reliance Short On Solar). According to Rystad, Europe is on track to produce 3 million tons of green hydrogen annually by 2030, but with REPowerEU it needs to now aim for 15 million tons instead.

"While industry and governments are heading in the right direction, their challenge is to lower the risks for green hydrogen investors and create incentives necessary to scale up quickly both the demand and supply," explained Rystad Energy's Head of Hydrogen Research, Minh Khoi Le. "Fundamentally, a world where green hydrogen fulfills the role currently played by oil, gas and coal will look very different."

Le said the coming decade is a 'make or break' one for green hydrogen to establish itself as a key energy source globally if it is able to increase production to over 10 million tons globally by 2030 for $1.5 per kg or even less.

First the COVID-19 pandemic and now the Russian invasion of Ukraine have made the world realize the importance of expanding renewable energy at a faster rate and developing a local supply and logistical set up. Green hydrogen also promises to decarbonize industries and also offers potential for exports, which is being widely explored across the globe as a new revenue generating source.

Now China too has joined the club with an aim to produce up to 200,000 million tons of green hydrogen annually by 2025.

"While it is challenging and unlikely for hydrogen to be used as a complete replacement fuel for thermal power plants, mixing hydrogen with natural gas or co-fire ammonia and coal to generate power can be a step toward reducing the use of fossil fuel," the analysts believe. However, the long-term strategy is to electrify the energy sector and use hydrogen and synthetic fuels mainly for transport and heat sectors.