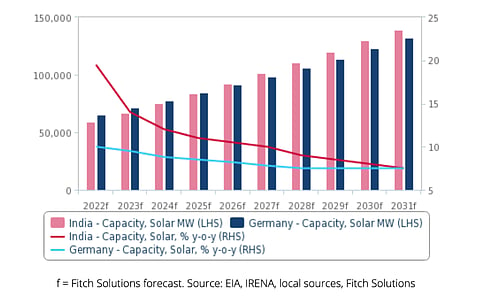

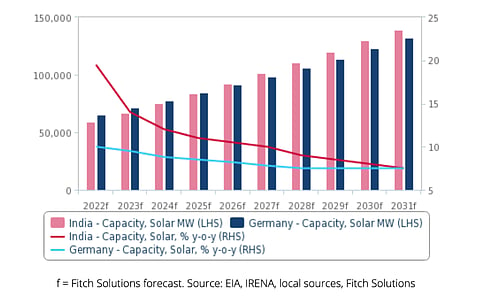

Between 2022 and 2031, India is likely to bring online more than 90 GW new solar capacity, along with Germany adding 72 GW, as the 2 solar power outperformer markets in Fitch Solutions Country Risk & Industry Research latest commentary that also sees Saudi Arabia as the market to watch.

India

In the Global Solar Power bi-annual report, Fitch analysts sees India adding this capacity over and above 49.34 GW it installed cumulatively till the end of 2021. The addition of more than 90 GW by 2031 will take the cumulative to 139.53 GW.

Robust government support, large project pipeline and ongoing private investment are positives that are likely to drive installations in this market. The report writers count the country's project pipeline currently standing at 60.5 GW in the form of 117 projects.

Analysts also point out the trouble points. Higher equipment costs, logistical bottlenecks, underdeveloped grid network and the possibility of higher duties on imported solar cells and modules are some of the fears that can lead to increased uncertainty in the near to medium term future.

"While we have seen the market take steps to improve grid access, reduce bureaucratic hurdles in licensing and approvals, and build out its domestic solar module manufacturing capacity, we expect India to fall significantly short of its 300 GW target for solar capacity by 2030," opine the analysts.

Germany

Backed by strong investor and consumer interest along with government support, Germany is anticipated to take its cumulative installed solar capacity to 131.93 GW by 2031, up from 59.56 GW at the end of 2021—an average increase of 8.3% YoY during the time frame.

Germany aims to grow its solar PV capacity to 215 GW by 2030 and one of the measures to get there is increase in solar auctions (see German Government Agrees On Higher 2030 Solar Goal Of 215 GW).

A steady growth in solar sector is expected in Germany and will come from strong government support and restructured policies for the renewable energy sector. The rooftop solar market too continues to grow, contributing to the overall numbers.

Saudi Arabia

At the end of 2021, Saudi Arabia had installed an aggregate of 518 MW of solar PV capacity, which Fitch analysts forecast to grow to 5.65 GW by 2031. Under its National Renewable Energy Programme ((NREP), the country aims to grow its solar energy capacity to 40 GW by 2030 (see Saudi Arabia Aims For 40 GW Solar By 2030).

The report points at the target of 2.9 million tons of hydrogen production on annual basis by 2030 as providing a boost to solar PV's prospects. Even though it is not clear what will be the share of green hydrogen in the scheme of things, analysts believe 'presence of large-scale green hydrogen projects in the pipeline indicates that renewable hydrogen will form a significant proportion of this production' hence further investment in solar power can be expected over the coming years.

"With tangible growth in the solar power sector only appearing in the past 2 years, policy constraints on foreign private ownership in the industry, as well as the dominance of large incumbent state-owned utilities, will present hurdles to investors seeking to participate in the market," they add.