Shoals exceeded its net revenue guidance for Q2 2024 to report $99.2 million

Lower sales due to project delays continued to impact its business, according to the management

Addition of 12 GW MSA to the Blattner deal gives it visibility to the business ahead

It has revised annual guidance, pulling it down citing near-term uncertainty and volatility

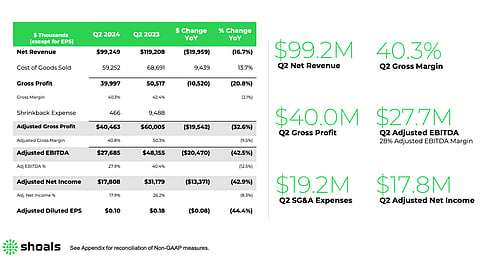

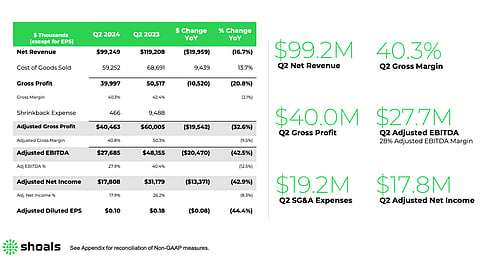

US-based electrical balance of system (EBOS) supplier Shoals Technologies Group continues to feel the impact of project delays as lower sales volumes pulled down its net revenues by 17% Year-over-Year (YoY) to $99.2 million in Q2 2024. Nevertheless, it managed to exceed the guidance of $85 million to $95 million.

Its net income declined to $11.8 million, compared to $18.9 million in the previous year, along with gross profit that went down to $40 million from $50.5 million in Q2/2023.

The company’s adjusted EBITDA declined to $27.7 million, having dropped by $20.5 million from the last year when it reported $48.2 million.

Referring to new commercial agreements, new product introductions and its maiden share repurchase program during the quarter, Shoals’ CEO Brandon Moss addressed the ongoing challenges for the company.

“While we are not immune to the ongoing variability many are experiencing within our markets, we remain focused on what we can control and influence: expanding our offering, improving our operational capabilities, and taking exceptional care of our customers. The early results can be seen in backlog and awarded orders increasing by 18% year-over-year, to a record $642.3 million at the end of the quarter,” said Moss.

Backlog and awarded order volume increased 4% sequentially with the addition of new customers as demand increased from projects in 2025 and beyond, and ‘robust growth’ in international markets which represent over 12% of backlog and awarded orders.

Shoals expanded its June 2023 10 GW master supply agreement (MSA) with projects installer Blattner Company adding another 12 GW to the existing MSA through June 2027. According to analysts at TD Cowen, this agreement provides a line of sight to 20% market share with a single customer.

Guidance

Citing ‘shifting order patterns’ resulting from the near-term uncertainty in the utility-scale solar market, the management has provided a cautious guidance for Q3 2024 revenues to range within $95 million and $105 million. Adjusted EBITDA is guided to range from $25 million to $30 million.

For full-year 2024, Shoals has reduced its annual revenue guidance from $440 million to $490 million to now within $370 million to $400 million. Adjusted EBITDA is guided as $96 million to $110 million, while net income should reach $62 million to $76 million.

The revised annual guidance, explained Moss, is due to near-term uncertainty and volatility resulting from the current political cycle, potential tariffs, and interest rates as these factors impact project planning by developers.

Philip Shen of Roth MKM agreed with this view, identifying ‘challenged module availability’ due to the SEA AD/CVD tariff process as an additional headwind for the US market.

Shoals’ management, however, is confident of the market recovery in the long term with the data center growth, re-shoring of US manufacturing, electrification of transportation and increased weather volatility.