India’s solar module capacity is set to surpass 120 GW by 2030, says Sinovoltaics

Government incentives and local expansion are fueling India’s rise as a global solar manufacturing hub

Despite growth, reliance on imported materials and equipment remains a major bottleneck for self-sufficiency

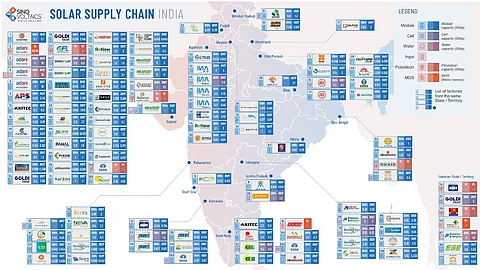

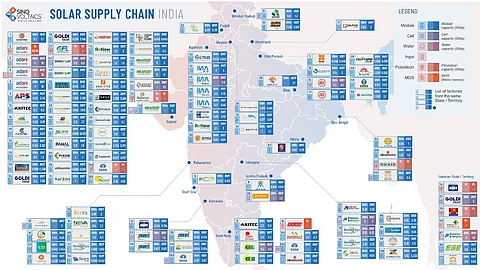

India’s solar sector is gaining global traction, with the Dutch-German consultancy Sinovoltaics’ 2025 supply chain map projecting the country’s module manufacturing capacity to exceed 120 GW by 2030. Its backward integration is expanding fast, too.

The country had only 8 GW of solar module production capacity in 2017, which has now grown to 68.4 GW. Its solar cell manufacturing capacity has expanded from 3 GW in 2017 to 24.6 GW, according to the report, and is likely to reach 65 GW by 2030. Ingot production is set to double from 14 GW to 28 GW during this period.

Sinovoltaics pegs India’s current metallurgical-grade silicon production capacity at 300,000 tons. It is planned to expand further, but the pace has slowed due to declining global prices.

New companies and the growth of existing ones are helping India become an important part of the global solar panel industry, according to Sinovoltaics’ updated India Solar Supply Chain Map 2025. It lists key names including Reliance Industries in Gujarat, Evervolt’s base in Andhra Pradesh, Zuvay Technologies in Gujarat, Avaada in Maharashtra, Group Surya in Bihar, and Luxra in Maharashtra.

Indian companies like Vikram Solar and TATA Power are also starting operations in the US, showing that India is on track to become a major hub for making and exporting solar panels.

“India is rapidly becoming a global hub for solar manufacturing and exports,” explains Sinovoltaics CEO Dricus de Rooij. “The addition of key manufacturers in our updated map reflects the industry’s dynamic expansion.”

Analysts at Sinovoltaics attribute this surge to government initiatives, like the Production-Linked Incentive (PLI) scheme and strategic import duties (see India To Impose ALMM For Solar Cells From June 1, 2026).

However, the sector still relies heavily on imported raw materials and high-end manufacturing equipment, which the report writers believe underlines persistent challenges to achieving full self-reliance.

The complete report is available for free download on Sinovoltaics’ website.