SMA Solar’s H1 2025 sales declined to €684.9 million due to weak home and business demand

Sales for the home and business solutions division dropped sharply, causing a negative EBIT of €129.2 million

Large-scale and project solutions sales grew, lifting the segment’s EBIT to €113.4 million despite market uncertainties

Order backlog of €1.16 billion comprises mainly large-scale and project solutions business, mainly in the Americas

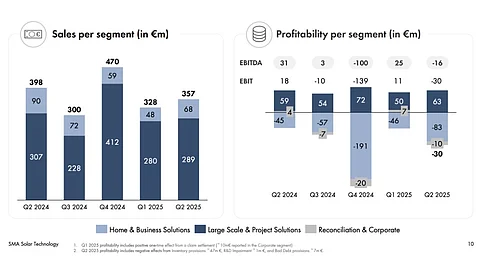

SMA Solar Technology AG’s sales in the first half of 2025 decreased to €684.9 million from €759.3 million last year. The drop was driven by declining demand and strong price competition in the home and business solutions (HBS) division.

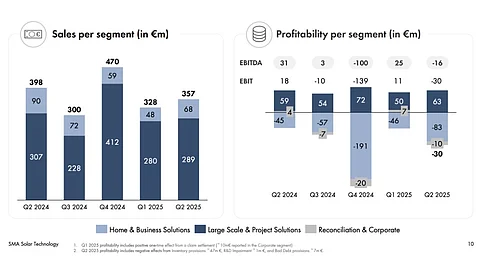

This division brought in €116.1 million in total sales during the reporting period, compared to €223.5 million last year. Split into its constituents, the home subsegment contributed €54 million and commercial and industrial (C&I) €62.1 million. Its EBIT was in the negative, at €129.2 million, due to a decline in sales and inventory write-offs.

“The market for residential and commercial systems remained weak in the first half of 2025. Alongside declining growth rates in Germany, competition and price pressures from Asian suppliers has once again risen. Furthermore, some distributors have persistently high inventory levels, which are only being reduced very slowly,” shared SMA CEO Jürgen Reinert.

Business for the German solar inverter manufacturer was driven by the large-scale and project solutions (LSPS) division, which recorded an increase in sales from €535.8 million in H1 2024 to €568.8 million in H1 2025. Its EBIT of €113.4 million increased from €100.5 million due to higher sales and the associated increase in productivity. While the management’s outlook for this segment is positive, it admits to uncertainties arising due to customs duties and unclear safe harbor requirements under the One Big Beautiful Bill Act (OBBBA).

At the group level, this impacted SMA’s EBITDA, which was down year-on-year (YoY) from €80.6 million to €55.1 million.

SMA’s order backlog totaled €1.16 billion, with 3 quarters or €848.3 million attributed to the product business. The LSPS business in the Americas accounts for 47% of the total.

For FY 2025, the company guides for between €1.5 billion and €1.55 billion in sales, while EBITDA is expected to range from €70 million to €80 million.

The company continues to press ahead with its restructuring efforts, expecting to overachieve its overall savings target for 2025. Its global workforce decreased by 716 as of June 30, 2024, to 3,878 as of June 30, 2025. SMA says it is using temporary employees to absorb order fluctuations.