On August 12, 2021 Solar PV inverter manufacturer from Germany SMA Solar Technology AG reported 12% growth in order backlog in H1/2021 over previous year. It confirmed its annual sales guidance for 2021 despite fearing delivery capacity constraints for the company in H2/2021 due to ongoing strained supply for electronic components (see COVID-19 Brought Down SMA Solar's H1/2021 Sales).

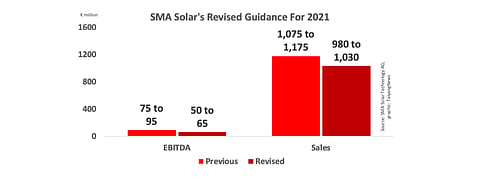

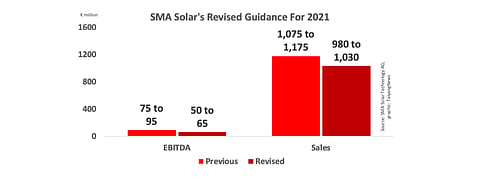

Less than a month later, the management has pulled down the annual sales guidance for 2021 to range between €980 million and €1,030 million, and EBITDA between €50 million and €65 million. This is down from its previous forecast of €1,075 million to €1,175 million for group sales, and €75 million to €95 million for EBITDA.

It attributes the reason for this change to 'undersupply of electronic components currently affecting the entire electronics industry'. SMA Solar has reported latest cancellations of 'firmly promised delivery quantities', something it didn't see coming in the short term. Some large-scale PV projects are also being pushed back by investors to 2022, it admitted.

"We continue to expect sales in the second half of the year to be higher than in the first half, but in our estimation to remain below the most recently forecast level," said CEO Jürgen Reinert who added that the company continues to work on securing deliveries and compensate for the delay.

Analysts at Cowen believe about half of the revenue guidance revision by SMA is utility scale and half due to lack of components affecting string inverter production. Even though the company leadership maintained that the detention of solar panel imports over forced labor concerns in the US have yet to reach SMA, Jeffrey Osborne believes it is a concern area that needs to be watched out for, especially since the company has a 30% to 40% share of US utility scale inverters.