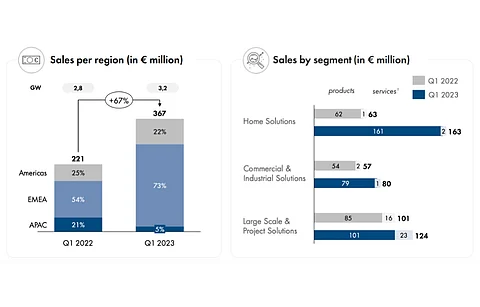

Consistent high demand and electronic components supply chain improvement were major reasons for SMA Solar Technology's 66.5% annual and 7.3% quarterly increase in Q1/2023 sales of €367.2 million, led by Europe Middle East and Africa (EMEA) region accounting for 73% share.

EMEA raised its share from 54% last year when Americas accounted for 25% and APAC 21%. The last 2 markets contributed 22% and 5% sales share in Q1/2023.

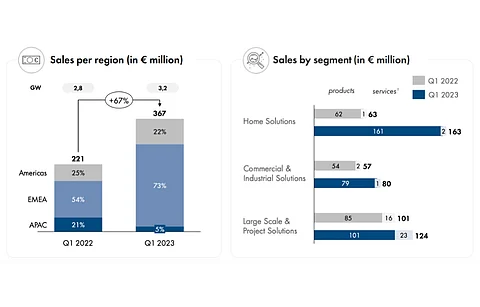

All segments improved their business performance in the reporting quarter led by €163 million in home solutions, €124 million in large scale and project solutions, and €80 million in commercial and industrial (C&I) segment.

EBITDA increase of 305% to €60 million and EBITDA margin of 16.3% up from 6.7% last year was also attributed to positive effects from capacity utilization and current product mix. Net income went up from €3 million last year to €52 million in Q1/2023.

"However, we will not be able to continue the strong all-round profitability of the first quarter on a totally linear basis throughout the year as a whole," explained SMA CEO Jürgen Reinert. "The reasons for this include changes to the product mix over the course of the fiscal year, seasonal costs and planned investments that will allow us to take advantage of the current growth opportunities."

To this, TD Cowen's Jeffrey Osborne opined, "Historically, solar stocks trade best when gross margin is expanding, and we feel management needs to do a more compelling job of laying out a plan for improved profitability in C&I and Large Scale."

It sold 16% more with 3.236 GW on annual basis, but dropped over 7% quarterly.

SMA Solar exited Q1 with an order backlog of €2.468 billion including €2.1 billion in the products business, up from €2.07 billion at the end of Q4/2022. EMEA region accounts for 67% of the current backlog.

Buoyed by its order backlog, management has reiterated its FY 2023 previous forecast of between €1.45 billion to €1.6 billion sales and within €135 million and €175 million EBITDA. This is a raised guidance from what it previously offered (see SMA Solar Exceeds Revised 2022 Guidance).