Higher solar PPA prices in North America in Q4 2025 reflect clearer visibility on tariffs, costs, and adjustments to reduced tax credits under OBBBA, says LevelTen Energy

Over 75% of solar PV projects due online before 2029 are still expected to qualify for tax credits

Headwinds in the North America market are expected from stringent federal permitting, Section 232 investigation, and pending FEOC rules that could add costs and delays

In Europe, low and negative power prices and oversupply are weighing on PPAs, pushing interest toward storage and hybrid projects

Analysts believe the EU Grids Package could ease grid bottlenecks and support future demand

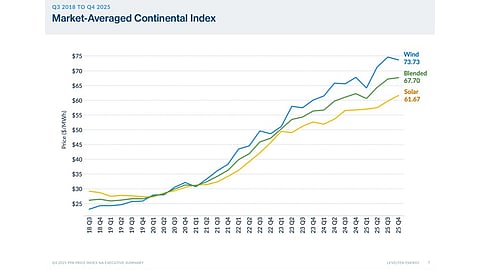

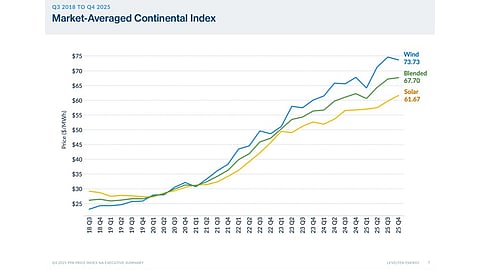

The P25 solar power purchase agreement (PPA) prices in North America went up by nearly 3.2% on LevelTen Energy’s Market-Averaged Continental Index in Q4 2025. It was a different story in Europe, however, where prices dropped for the 3rd straight quarter by 1% year-on-year (YoY).

In North America, the increase followed a 3.2% price jump in the previous quarter. During the reporting quarter, not all markets in the region saw price increases, as some posted modest quarterly declines, says LevelTen Energy in its Q4 2025 PPA Price Index North America. On an annual basis, though, the price increase was close to 9% at $61.67/MWh.

P25 prices for wind energy, on the other hand, dropped by 1% quarter-on-quarter (QoQ) to $73.73/MWh while they increased by almost 9% on a YoY basis, same as for solar.

Analysts believe this increase in solar PPA prices may be a result of greater clarity around the pricing impacts of tariffs and other costs among developers. They are now adjusting their business around the tax credit cuts introduced by the One Big Beautiful Bill Act (OBBBA).

As firms ‘ruthlessly reprioritized’ their project pipelines in H2 2025 to align with the OBBBA measures and safe harbor provisions, LevelTen Energy says it surveyed developers with more than 230 GW of combined project pipelines. The result was encouraging since over 75% of this pipeline, expected to enter commercial operations before 2029, will be eligible for tax credits.

Nevertheless, uncertainty related to the Section 232 tariff investigation, as well as harsh federal-level permitting requirements, have stalled development across the country, adds LevelTen (see US Launches National Security Investigation Into Polysilicon Imports and Elevated US Federal Scrutiny For Wind & Solar Energy Projects).

The US industry expects further headwinds from the Foreign Entity of Concern (FEOC) guidance, which is still expected to be announced. This will add compliance costs and hurdles to tax credit qualification. In the meantime, developers are working to establish pricing equilibrium.

For corporate buyers, there is one additional upcoming challenge: the revised Greenhouse Gas Protocol (GHGP) Scope 2 standards. Expected to be finalized in 2027 and implemented in 2028, these updated standards could create ‘more stringent inventory accounting standards for renewable procurement’, especially with regard to physical deliverability and hourly matching.

Proposed stricter accounting rules are controversial, with supporters citing climate benefits and critics warning that higher administrative costs could eventually lead to reduced corporate demand. This will be important to watch out for since LevelTen says 97% of companies use GHGP to track and disclose their emissions.

Yet, technology companies continue their PPA signing spree, securing renewable energy with potential for battery storage to meet the anticipated demand from data centers to bring them online faster (see Google Locks In 1 GW Solar PV Supply For US Data Centers).

Europe

On an annual basis, P25 solar PPA prices in Europe dropped by approximately 8% and 1% on a QoQ basis to €57.44/MWh. For wind energy, the sequential decline was 3% at €85.96/MWh (see North American PPA Prices Rise, Europe Sees Dip In Q3 2025).

LevelTen analysts attribute the growing number of hours with low and negative power prices in Europe, especially in Germany and Spain. This lowers the value of solar-only power contracts, forcing developers to offer lower PPA prices to reflect current market conditions. Moreover, oversupply driven by lower demand is also impacting solar PPA prices.

To deal with this, the addition of storage is being explored actively in the market, which will lead to a hybridized energy pipeline and guide the PPA market and corporate offtake terms , according to the Q4 2025 PPA Price Index Europe.

The European Commission’s Grids Package is expected to enable better integration of renewable energy, which could once again boost demand. This exempts grid-upgrade and storage projects from some environmental reviews and mitigates bottlenecks.

Both reports can be purchased on LevelTen Energy’s website.