In Q4/2022, solar power purchase agreement (PPA) prices developers offered for contracts rose in Europe with high development costs and unstable regulatory environment, as well as in North America thanks to stiff supply chain challenges, according to renewable energy transaction platform LevelTen Energy.

Europe

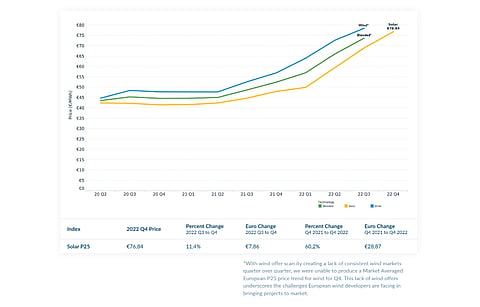

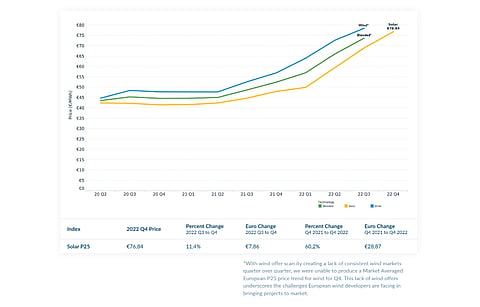

The P25 price index, representing 25th percentile PPA prices on LevelTen's platform, for solar projects in Europe went up 11.4% sequentially to €76.84/MWh which was a 60% annual increase, according to LevelTen's Q4 2022 PPA Price Index Europe report.

Having studied 125 PPA price offers on 94 wind and solar projects in 16 countries, analysts found solar prices rose most in the reported period in the UK with a 30% jump which they attribute to more capacity going to government auctions leaving less for corporate buyers. Italy followed next with a 30% increase.

To avoid 'hypercompetitive markets', an increasing number of developers are exploring emerging markets which could be Greece and Hungary. LevelTen's Senior Manager of Developer Services for Europe, Frederico Carita doesn't see much demand in central and eastern Europe as of now as these markets are still attached to short-term gas and coal contracts. Carita added, "But while these markets remain under the radar, buyers can take advantage of very compelling PPAs from reputable developers operating there."

Only 12% of all European offers on its marketplace were found by LevelTen to have made it for wind energy which it says is due to lack of land availability and years-long lead times for turbine deliveries. "The markets desperately needs permitting reforms to kick in faster," according to Carita. P25 wind prices ranged between €66.0/MWh and €69.0/MWh.

LevelTen warns that renewable energy investment appetite can take a hit if policymakers continue to bring in 'guardrails' to keep wholesale prices 'artificially low' by way of price gaps and cap on gas prices.

Nonetheless, European renewables PPA market has a bright future ahead as corporates see these as cushioning them from volatile energy markets and achieve their sustainability goals.

North America

Solar PPA prices in the North American market also went up 8.2% QoQ and 33.3% YoY to $45.66/MWh in Q4/2022 with the market facing supply chain challenges. With the Uyghur Forced Labor Prevention Act (UFLPA) in place, module imports into the US are reduced to a 'trickle' exacerbating problems with project development schedules, prices and PPA deals.

According to LevelTen, "Full implementation of the Inflation Reduction Act (IRA), local interconnection queue reforms, and other regulatory issues will continue to play a role not just in PPA price calculations, but also in investor appetite for project development in certain areas of the country."

Analysts in Q4 2022 PPA Price Index North America hope the UFLPA compliance procedures to become more efficient for some relief to come for solar prices.

PPA price offers uploaded by developers on its website for projects in the 7 US independent system operator (ISO) markets, including CAISO, ERCOT, ISO-NE, MISO, NYSIO, PJM and SPP, along with Canada's ISO-AESO, shows higher PPA prices for solar.

"It will take years to work through PJM's current backlog of interconnection requests," said Senior Director of Developer Services at LevelTen, Gia Clark. "And the developers who have received their interconnection studies are telling us that estimated costs are much higher than anticipated, leading to higher PPA prices. Another side effect is that PJM's overflowing demand is spilling into other ISOs, putting more pressure on markets like MISO."

Contrary to solar, the P25 wind PPA offer prices in the market for wind energy projects dropped 1.9% to $48.71/MWh making it the 1st time this technology segment has reported a drop on LevelTen's platform in 2 years.

The complete reports for both European and North American markets can be purchased on LevelTen's website.