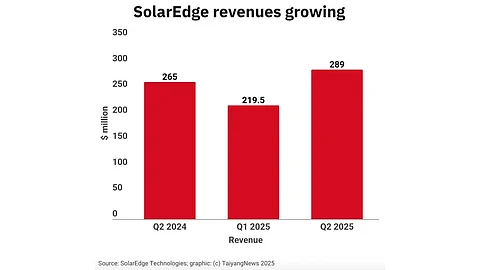

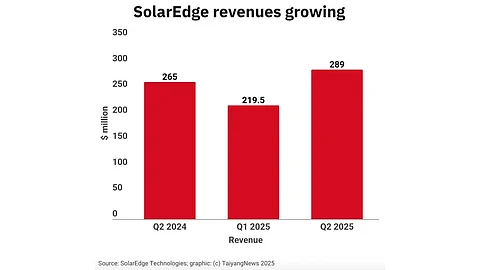

SolarEdge’s Q2 2025 revenues rose 32% QoQ and over 9% YoY to $289.4 million, even as its losses widened

The US market made up 66% of the company’s sales, with Europe at 23% and other markets at 11%

The management sees OBBBA incentives, domestic content rules, and storage tax credits as long-term US growth drivers

Israel-based SolarEdge Technologies, a global supplier of solar inverters and optimizers, posted its 2nd straight quarter of revenue growth. In Q2 2025, its revenues rose to $289.4 million, up 32% from the previous quarter and more than 9% from a year earlier.

The company's losses also widened. GAAP operating loss expanded to $115.5 million from $102.7 million in the previous quarter, as did its net loss of $124.7 million compared to $98.5 million in the same period last year.

Excluding $8 million from discontinued operations at its Kokam energy storage division, SolarEdge’s total revenues were $281 million. The US accounted for 66% or $185 million for the quarter, while Europe represented a share of 23% with $65 million. International markets amounted to $31 million, representing 11% of the revenue share.

The company shipped 1,194 MW AC of inverters and 247 MWh of batteries for PV applications during the reporting quarter. It says the European inventory reached ‘normalized’ levels at the end of the reporting quarter. In the previous quarter, its shipments comprised 1,208 MW AC of inverters and 180 MWh of batteries for PV applications.

Speaking about the regulatory changes in the US renewable energy sector in the view of the One Big Beautiful Bill Act (OBBBA), SolarEdge CEO Shuki Nir said that the bill validates its multi-year strategy of onshoring manufacturing to the US by preserving the 45X advanced manufacturing credit for the next 7 years.

Since solar customers will be required to comply with Foreign Entity of Concern (FEOC) requirements and meet domestic content thresholds, it works for SolarEdge’s US manufacturing and supply chain strategy. Nir also sees the extension of storage tax credits as working in its favor.

He shared, “With the improved visibility this law provides, we intend to manufacture in the US, and to ship US-made SolarEdge products both domestically and across the globe, for years to come.”

SolarEdge recently announced the ramp-up of its new manufacturing site in Utah’s Salt Lake City, where it is now manufacturing and shipping the SolarEdge USA Edition Home Battery. Along with its Florida and Texas factories, the company now produces residential inverters, power optimizers, and battery products in the US.

Nir shared that while residential solar demand may drop in 2026 as Section 25D credit ends by the end of this year, the company expects a partial recovery through growth in third-party ownership (TPO) systems, supported by ongoing 48E credits. “We believe we are well positioned to benefit from this shift given our strong position and product fit with TPOs,” he added. Recently, SolarEdge entered a multi-year agreement with US commercial rooftop solar developer Solar Landscape to supply its US-manufactured equipment to be deployed on more than 500 C&I rooftops in the country.

SolarEdge guides its Q3 2025 revenues to range between $315 million and $355 million. It also expects non-GAAP gross margin to be within the range of 15% to 19%, including close to 2 percentage points of new tariff impact.

Speaking of the US, TaiyangNews will explore the US solar market in view of the regulatory shifts at the upcoming RE+ 2025 event in Las Vegas, US. It is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing and future strategies for the players in light of the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.