SolarEdge’s Q4 revenue rose 70% YoY, but declined 1.4% from Q3; full-year 2025 revenue increased 31% to $1.18 billion

The US accounted for 59% of Q4 revenue despite a 3% QoQ drop; international markets grew 2% QoQ

Power optimizers led revenue in Q4, followed by batteries and inverters; shipments included nearly 98,800 inverters, 2.87 million optimizers, and 280 MWh of batteries

GAAP net loss increased to $132.1 million in Q4, partly due to the sale of its e-mobility business

The company plans to focus on profitable growth in 2026, scale its Nexis platform, and invest in AI data center power solutions

SolarEdge Technologies, a manufacturer of solar inverters, optimizers, and batteries, exited Q4 2025 with 70% year-on-year (YoY) revenue growth, meeting the higher end of its guidance.

The company highlights that this growth is without the benefit of any significant one-time revenue pull-forward and that it outperformed the typical seasonal decline.

While the US market accounted for $198 million, or 59%, of the company’s total quarterly revenue, it declined by 3% quarter-on-quarter (QoQ). Europe’s share also dropped by 1% QoQ, representing 30% of the revenues at $99 million. International markets brought in $37 million or 11% of revenues, with a 2% QoQ increase.

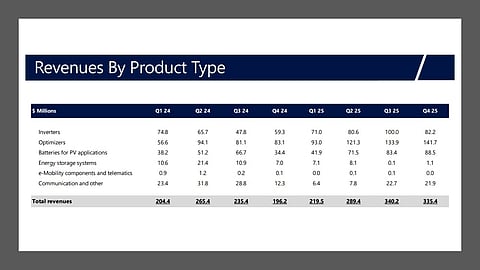

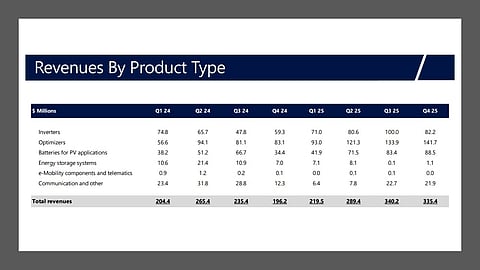

The company’s power optimizer business led the revenue for the quarter, bringing in $141.7 million ($133.9 million in Q3 2025), followed by $82.2 million from inverters ($100 million in Q3 2025) and $88.5 million from batteries for PV applications ($83.4 million in Q3 2025).

Close to 98.8 thousand inverters, 2.87 million optimizers, and 280 MWh of batteries for PV applications shipped during the quarter were recognized as revenue. GAAP gross margin reached 22.2%.

Yet, compared to the previous quarter, its Q4 revenues dipped 1.4%. It also widened GAAP operating loss to $48.3 million from $35.2 million, and GAAP net loss from $50.1 million in Q3 to $132.1 million (see SolarEdge Posts 3rd Straight Quarter Of Revenue Growth In Q3 2025). CFO Asaf Alperovitz said the GAAP net loss of approximately $8 million was due to the company selling the remainder of its E-mobility business for $12 million.

For the full year 2025, SolarEdge’s revenues increased by 31% YoY to $1.18 billion, with a positive GAAP gross margin of $16.6% compared to a negative 97.3% in 2024. GAAP net loss narrowed from $1.81 billion in the previous year to $405.4 million (see SolarEdge Reports 3rd Consecutive Quarter Of Revenue Decline).

Its full-year shipments totaled 465.7 thousand inverters, 10.8 million optimizers, and 928 MWh of batteries for PV applications.

The US market remained its revenue driver as the company says it increased market share here across all categories while gaining share in the C&I segment.

SolarEdge CEO Shuki Nir said, “But 2025 was just the first step in our turnaround journey. It was about defense. Restoring discipline. Generating strong free cash flow. Rebuilding margins. 2026 is about shifting to offense while keeping this discipline intact. We will focus on moving towards profitable growth, gaining share, scaling Nexis, and investing in new high-growth adjacencies such as AI data center power.”

The company plans to expand into power solutions for AI data centers, where electricity supply is becoming a key constraint. As companies like Nvidia promote a shift to 800V DC systems, Nir said SolarEdge believes its experience with high-voltage DC technology gives it an advantage, representing “a multi-billion dollar addressable opportunity over time.” The company is developing a solid-state transformer that can convert 34.5 kV directly to 800 V DC with over 99% efficiency, targeting a large long-term market opportunity.

Nir also said that the company’s planned rollout of Nexis, an all-in-one residential, modular solar-plus-storage platform, is on schedule. It plans to ship this product in high volume.

For Q1 2026, SolarEdge targets revenues of between $290 million and $320 million with a non-GAAP gross margin of 20% to 24%. Non-GAAP operating expenses are expected to range between $88 million and $93 million.

Analysts at TD Cowen expect the company’s gross margin expansion to continue in 2026, driven by exports, Nexis, and single SKU. “By early 2027, each will be fully underway, which contributes to our 30% gross margin estimate for 2027,” they add.