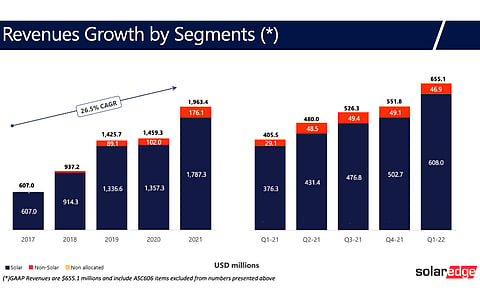

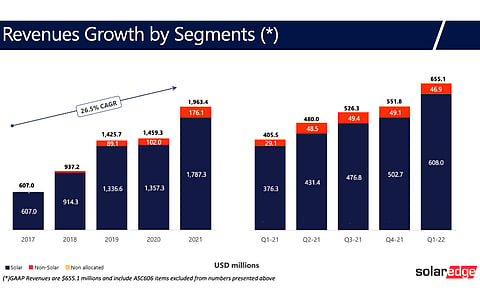

SolarEdge Technologies, Inc, the Israel headquartered solar PV inverter supplier, ticked all the right boxes with its Q1/2022 revenues of $655.1 million having gone up 19% QoQ and 62% YoY, thanks to strong solar business in the US and Europe.

Solar segment brought in $608 million to the quarterly revenues, having gone up 21% and 62%, respectively making it a record high for this business division. Demand was robust from not only the US, but also 14 European nations as Europe showed 'significant increase' in demand including from the Netherlands, Italy, Poland, Spain, Switzerland and the UK.

Yet solar segment's gross margin dropped down to 30.2% from 32.8% in the previous quarter and from 39.7% in Q1/2021 (see SolarEdge's Q4/2021 Financial Results).

The management cited 4 reasons for the continuous dip namely, shipping expenses related to finished goods and for raw materials; costs paid to contract manufacturers to continue manufacturing during Chinese New Year period along with ramp-up expenses in Mexico, China and Vietnam; and increase in revenues from batteries and devaluation of Euro against US Dollar.

The currency fluctuation is factored in by the company in its Q2/2022 guidance as well.

The company took air route to ship products to Europe in the quarter which it admitted put pressure on GAAP gross margin that declined to 27.3% in the reporting quarter, down from 29.1% in the previous quarter and 34.5% in Q1/2021 (see SolarEdge Shipped 1.69 GW AC Solar Inverters In Q1/2021).

Nonetheless, SolarEdge expects 'strong growth momentum' in Europe in the future with its current dynamics including elevated electricity prices, and supportive government initiatives. In the US, CEO Zvi Lando told analysts that the company does not see its projects being delayed or any changes to its backlog and does not visualize any short term impact in Q2 and Q3 as of now.

"The backlog is very strong and just the amount of calls that we're getting for expediting is an indication of the situation. That said, new project development for larger-scale projects into the end of the year and the beginning of next year could be impacted, in particular, in large C&I where we are active and in utility," explained Lando.

In all, it shipped 2.13 GW capacity in Q1/2022 divided as 721 MW to the US, 1.1 GW to Europe and 309 MW to rest of the world. A total of 47% of the products shipped were to the commercial segment and 53% to residential.

Guidance

The inverter company has guided for Q2/2022 revenues within the range of $710 million to $740 million and solar segment bringing in $660 million to $690 million in revenues.

Non-GAAP gross margin for total revenues is expected within 26% to 29%, and that in the solar segment between 28% to 31%.