Sungrow achieved 40.34% YoY growth in H1 2025 with RMB 45.5 billion operating income

Overseas markets drove 58.3% of revenue, with growing microinverter adoption in Europe’s residential solar segment

The ESS segment surged 127.78% YoY, contributing RMB 17.8 billion and 40.89% of operating income share

Net profit rose 59.29% YoY to RMB 7.73 billion, supported by economies of scale and innovation

China-headquartered global solar PV inverter and energy storage systems (ESS) company Sungrow Power exited H1 2025 with a strong year-on-year (YoY) growth of 40.34% in its operating income of RMB 45.5 billion ($6.4 billion). It attributes the increase to its expanded market development and improved sales.

Overseas markets represented 58.3% of the total operating income during the reporting period, while China’s domestic market accounted for 41.7%. It expanded the inverter business in Europe, America, Asia Pacific, the Middle East, and Africa. In Europe, particularly, Sungrow says its microinverters were widely used in balcony and residential solar systems.

“Due to trade barriers, domestic new energy manufacturers face the risk of export obstruction. To this end, the company deepens its global layout and localization, improves the level of localized operations in overseas markets, actively develops global manufacturing and supply layout, strengthens business compliance and risk system construction, pays attention to the direction of trade policies of various countries, makes contingency plans, and establishes risk management system to enhance the ability to cope with risks in international trade,” said Sungrow in its H1 2025 report.

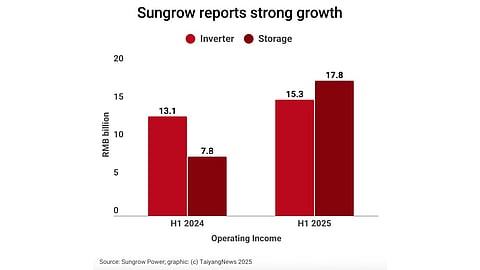

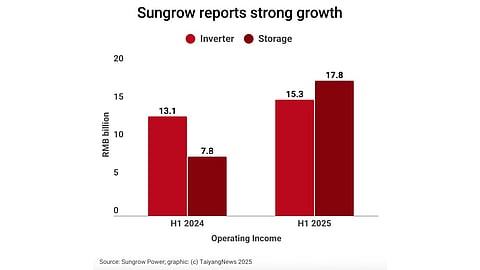

Product-wise, the ESS segment brings in more money as it represented a 40.89% share of the operating income, as it increased revenues by 127.78% YoY with RMB 17.8 billion ($2.5 billion).

In comparison, PV inverters and other power electronic conversion equipment accounted for 35.21% of group operating income with RMB 15.3 billion ($2.1 billion) revenues that increased by 17.06% YoY.

During H1 2024, their respective shares of the group operating income was 25.2% and 42.21%.

The Chinese supplier also boosted its net profit by 59.29% YoY to RMB 7.73 billion ($1.1 billion), and achieved a gross profit margin of 34.36%, or a 1.94% annual increase, for which it listed economies of scale and product innovation as the factors responsible.

During the reporting period, it launched 2 new solar inverters – a 400 kW string inverter and the split modular inverter, 1+X2.0 (see Sungrow Showcases Wide Range Of ESS Solutions At SNEC 2025).

Recently, Sungrow announced plans to issue H-shares and list on the Hong Kong Stock Exchange (HKEX) to strengthen its global presence, boost its international brand image, diversify financing channels, and enhance overall competitiveness.

Sungrow says it has an overseas solar PV inverter production capacity of 50 GW, with plans to further expand its global market penetration for inverters, energy storage, charging, power stations, and hydrogen businesses.

Sungrow leads Chinese manufacturers in Wood Mackenzie’s energy storage rankings as it offers strong competition to Tesla, especially expanding its market share in Europe and the Middle East (see Tesla Maintained BESS Lead In 2024; Chinese Firms Gain Ground).