Sunnova fears it would be unable to continue business as a going concern

The management blames lower tax equity contributions stemming from timing delays of ITC sales, fewer installed systems, and funds received in December as the reasons for the warning

It has already announced plans to trim over 15% of its workforce to reduce overhead costs

Soon after announcing plans to reduce costs with workforce reduction, US-based residential solar and battery energy storage supplier Sunnova Energy International has issued a warning regarding its ability to continue as a going concern.

While sharing its FY2024 financial results, the management said it does not have enough funds to meet obligations and manage operations for a period of at least a year, unless it takes additional measures. These may include managing its working capital, securing additional tax equity investment commitments or waivers of conditions to access existing tax equity commitments, and refinancing.

“Therefore, substantial doubt exists regarding our ability to continue as a going concern for a period of at least one year from the date we issue our consolidated financial statements,” it has stated.

Sunnova has contracted a financial advisor to manage certain aspects of its debt management and refinancing efforts. Earlier this month, Sunnova said it will cut close to 300 positions, or more than 15% of its workforce, to reduce its overhead costs (see Sunnova Energy To Trim Workforce By Over 15%).

This was despite Sunnova increasing its total cash by 11% in 2024 without issuing new corporate capital. Nevertheless, its unrestricted cash remained relatively flat, below the estimated $100 million increase.

Sunnova’s Founder and CEO William J. (John) Berger blamed the miss on lower tax equity contributions stemming from timing delays of ITC sales, fewer installed systems, and funds received in December classified as restricted.

“During 2024 and the first two months of 2025 we acted on several initiatives, including mandating domestic content for our dealers to increase our weighted average ITC percentage, raising price, simplifying our business to reduce costs, and changing dealer payment terms to align with our own funding sources. We believe, these actions better position Sunnova in the current environment and support positive cash in 2025 and beyond,” added Berger.

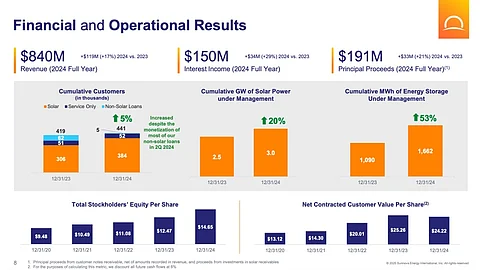

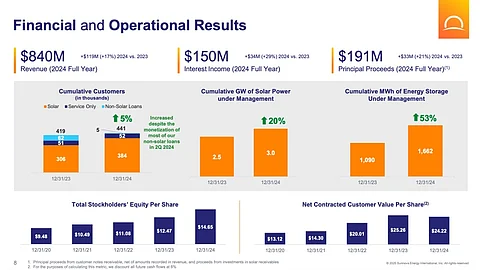

Meanwhile, its total revenues of $840 million were up 17% year-on-year (YoY) while interest income of $150 million was 29% higher over the same period. The company’s cumulative customer count improved by 5% over the course of the year, as did its cumulative GW of solar power under management that rose by 20% YoY to 3 GW. In the energy storage business division, Sunnova reported 53% annual improvement to 1.662 GW.

The US solar industry, especially for the residential segment, has been facing headwinds over the last year with higher interest rates. As demand continued to drop, SunPower, one of the biggest names in the space, was forced to declare bankruptcy in August 2024 (see SunPower Corporation & Subsidiaries File For Bankruptcy Protection Under Chapter 11).

Sunnova believes the residential solar market growth in the US will remain subdued in 2025 and has removed its guidance.

Roth’s Philip Shen believes the company’s struggles to pay its dealers has been going on for a year now. Nevertheless, its dealers seem confident of getting paid. Shen said there is a reasonable path for the company to navigate through this challenging time and rebound quickly which will happen as soon as the dealers start to get paid and confidence is restored, though macro factors have to cooperate.