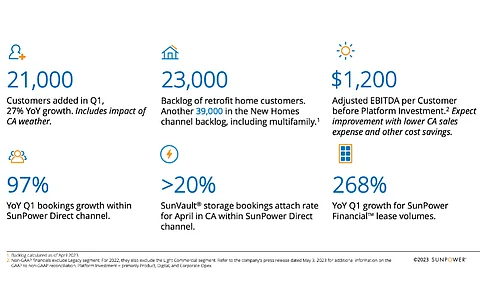

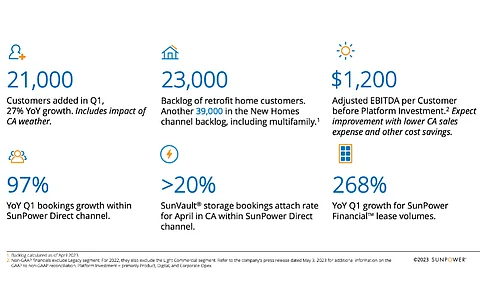

SunPower exited Q1/2023 with a 27% annual growth in customer count with the addition of 21,000 new ones, but reported GAAP net loss of -$50.7 million for the quarter. It said the loss was beset by unfavorable California weather conditions that kept crews idle, increased costs and delayed certain installations in the state. Management said it aims to catch up in California over the next few quarters.

At the end of Q1, the company had a backlog of 23,000 retrofit customers and counts another 39,000 in the New Homes channel backlog, including multifamily.

It also grew lease business by 268% YoY and plans to expand the lease offering in 2023 'following the passage of the Inflation Reduction Act and US Department of Treasury guidance related to the three various federal bonus tax credits'.

Its GAAP revenues increased 26% YoY, but dropped over 11% QoQ to $440.9 million, while adjusted EBITDA dropped down to $0.6 million, compared to $36.2 million in the previous quarter and $11.2 million last year.

"We exited the first quarter with high customer growth, significant new financing commitments, and unprecedented retrofit backlog driven by our efforts securing customers under NEM 2.0. This progress, despite challenging weather in California, validates the strength of the residential solar market and SunPower's ability to capture growing demand," said SunPower CEO Peter Faricy. "As retail electricity rates continue to rise and consumers urgently seek a more affordable and reliable source of energy, the solar value proposition remains strong."

SunPower management has reiterated its full year 2023 financial guidance for $2,450-$2,900 adjusted EBITDA per customer before platform investment and 90,000-110,000 incremental customers, resulting in $125-$155 million adjusted EBITDA for the year (see SunPower Grew Customer Base & Net Income In 2022).

It has also secured solar panel supply to 'fully address' its anticipated 2023 demand and beyond' with 3 new agreements.

The company has separately announced the same day of the financial results publication that it secured $550 million loan purchase commitment from credit funds and accounts managed by KKR. It says this commitment takes its year-to-date capital to a total of $1 billion of incremental solar loans for the company's customers.

"As demand continues to rise, we expect this additional capital will power our loan bookings volume into 2024 and enable SunPower to increase access to the benefits of solar for more homeowners," said SunPower's Interim CFO Guthrie Dundas.

Two days earlier, on May 1, Sunpower announced the appointment of Jennifer Johnston as the company's new executive vice president (EVP) and chief operating officer (COO), emphasizing her ' deep experience in organizations undergoing significant transformation' (see SunPower Appoints New Chief Operating Officer).