T1 Energy finalized a 437 MW supply deal with a major US utility, selling out its 2025 G1_Dallas capacity

It produced 1.22 GW of modules at G1_Dallas so far in 2025, converting one line from PERC to TOPCon

The company is preparing to start construction of its 5 GW G2_Austin solar cell fab in late 2025

T1 says the Corning deal will enable it to achieve FEOC compliance and maintain PTC eligibility

Following an ‘elevated cadence’ of customer inquiries after the passage of the One Big Beautiful Bill Act (OBBBA), US-based technology company T1 Energy finalized a 437 MW deal with a major US utility. With this agreement, T1 says its G1_Dallas solar module plant is sold out for 2025 on the low end of its 2.6 GW production plan.

Formerly FREYR, T1 Energy is maintaining its 2025 production plan of 2.6 GW to 3.0 GW at its 5 GW G1_Dallas solar module factory, where it has produced 1.22 GW since the beginning of this year through August 11, 2025. The company has converted 1 of the 3 production lines here from PERC to TOPCon. It continues to produce PERC modules at the request of a customer.

Meanwhile, the management says it continues to advance the 5 GW cell factory G2_Austin with 2.5 GW in the initial phase. This fab is scheduled to enter construction in Q3 or Q4 of this year. Offtake discussions are ongoing with prospective buyers. T1 says its customers have a pipeline of safe-harbored projects through 2029/2030.

T1 will source hyper-pure polysilicon and solar wafers produced locally from an affiliate of Corning as part of its plans to establish a domestic solar value chain. Wafer supply is expected to begin in H2 2026 as soon as the cell factory starts production (see T1 Energy Locks In US-Produced Silicon Wafer Supply With Corning).

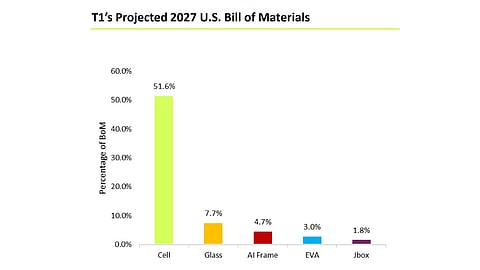

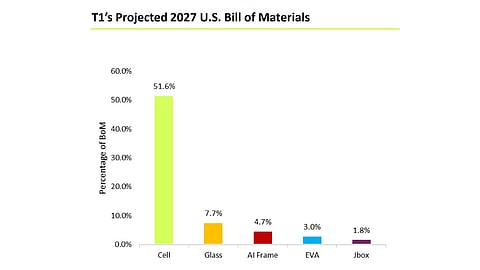

The manufacturer sees this Corning deal as a significant step towards achieving Foreign Entity of Concern (FEOC) bill of materials (BOM) compliance. Before year-end 2025, it plans to establish a BOM of 50% non-FEOC content to be able to maintain access to the Section 45X Production Tax Credits (PTC) and align itself with the OBBBA.

“Interest in domestic solar is accelerating on several fronts since early July. We’re seeing increased commercial sales, the pace of offtake agreement discussions is quickening, demand from hyperscale AI projects is phenomenal, and there’s growing interest in our G2_Austin solar cell project,” said T1 Energy CEO and Chairman of the Board, Daniel Barcelo. “It is clear the time to build a domestic solar supply chain is right now. That’s what we’re delivering.”

During Q2 2025, T1 generated $132.8 million in revenues from G1_Dallas, but reported a net loss of $32.8 million.

For 2025, it expects between $25 million and $50 million in EBITDA, but warns that it may end up near the lower end due to market uncertainties like reciprocal tariffs, AD/CVD, supply chain issues, and customer safe harboring backlogs.

T1 continues to maintain its long-term goal of $650 million to $700 million in annual EBITDA from both factories.

TaiyangNews will explore the US solar market in view of the regulatory shifts at the upcoming RE+ 2025 event in Las Vegas, US. It is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing and future strategies for the players in light of the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.