Order pushouts and cancellations due to high channel inventory pulled down the annual revenues of the US-based module-level power electronics (MLPE) producer Tigo Energy in Q4/2023. Its Q4 revenues of $9.2 million reflected a 70.1% drop from the previous year and a guidance miss.

The EMEA region accounted for 40% of its quarterly revenues, followed by the Americas representing 37% and APAC 23% of the share. GO ESS, which provides intuitive and flexible energy solutions, brought in 14% of total revenues, increasing its share from 8.4% in the previous quarter and 7.3% in the previous year.

Compared to $2.7 million of adjusted EBITDA in Q4/2022, Tigo reported a loss of -$11.6 million in the reporting quarter, with a net loss of -$14.8 million vis-à-vis net income of $0.9 million in the previous year.

The management said that with these headwinds, it had to cut down human resource by 15% as part of its restructuring measures.

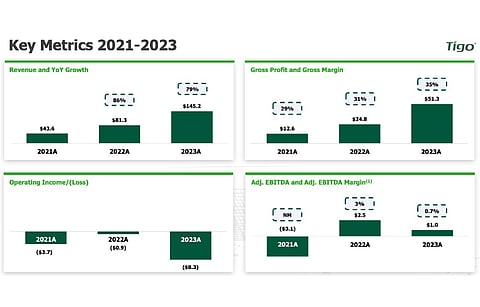

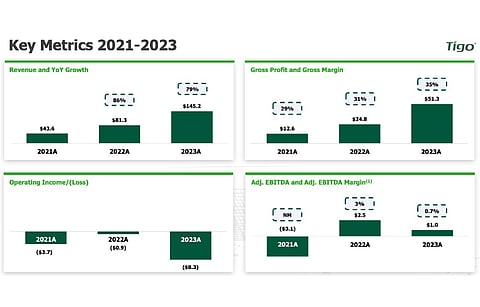

However, for full year 2023, its revenues jumped up 78.6% year-on-year (YoY) to $145.2 million with the EMEA bringing in 75% of the total. The Americas represented 17% and APAC 7% of the revenues during the year. GO ESS was a total 9.2% of the total revenues.

It did suffer an operating loss of -$8.3 million, up from -$0.9 million in the previous year, while the net loss for the full year narrowed to -$1 million, down from -$7 million in 2022.

"Our business grew significantly across several areas this year, even as our team managed ongoing marketplace weakness driven by order pushouts and cancellations through the second half of 2023," said Tigo Chairman and CEO Zvi Alon. "Also, our continued efforts in international markets helped us to substantially increase our EMEA and APAC revenues, both important areas of focus moving forward as well."

Tigo had earlier mentioned that it expects inventory levels to remain elevated in Q4/2023 and early 2024. The management has now reiterated its forecast.

"As we stated last quarter, we believe the ongoing inventory digestion cycle will be substantially complete by the end of the current quarter and that we are solidly positioned to expand our market share as the industry upturn emerges," added Alon. On a call with analysts post the financial statements release, Alon said the management is cautiously optimistic for the inventory levels to clear up as projected.

Even as the management sees continued but moderate growth in the EMEA market, high interest rates and net metering policies in the Americas could play spoilsport going forward to delay recovery 'until the second half of the year.'

Tigo will explore newer under-tapped geographies in 2024 such as those in South America, Asia-Pacific and Eastern Europe where 'rapid shutdown is gaining traction.'

The company expects to report revenues in the $9 million to $14 million range in Q1/2024, but adjusted EBITDA will be a loss within the range of -$8 million to -$12 million.

A supplier of smart hardware and software solutions for solar and energy storage market, Tigo deployed its 10 millionth flagship product TS4 during the year. It also added CPV Retail Energy and EDF Renewables Israel to its client list for Tigo Predict+ software that provides advanced algorithms for production and load forecasting.