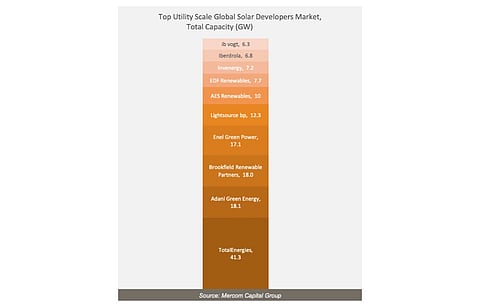

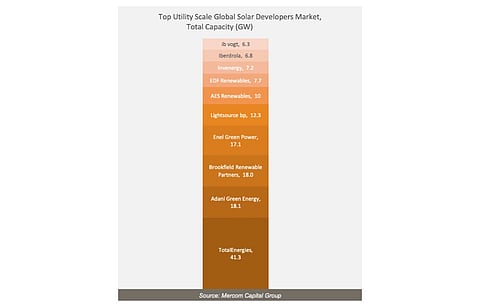

The world's top 10 large-scale solar PV project developers command 145 GW of the operational, under construction and awarded (PPA-contracted) solar PV projects capacity, including 95 GW in the pipeline. TotalEnergies of France leads the pack with a 41.3 GW share, including 12 GW of operational capacity, says Mercom Capital Group.

However, TotalEnergies' 12 GW portfolio is inclusive of its 50% stake in Clearway Energy Group, 49% stake in Casa dos Ventos and 20% stake in Adani Green Energy, points out Mercom in a new report.

The gap between TotalEnergies and Adani Green Energy of India, the company on the 2nd spot in the list, is quite wide as the latter had 18.1 GW in its kitty, during the July 2022 to June 2023 reporting period. Canada-based Brookfield Renewable Partners is 3rd with a 18 GW portfolio.

Italy's Enel Green Power (EGP) with 17.1 GW and Lightsource bp with 12.3 GW take the 4th and 5th positions, respectively. Others on the list are AES Renewables (10 GW), EDF Renewables (7.7 GW), Invenergy (7.2 GW), Iberdrola (6.8 GW) and ib vogt (6.3 GW), in that order.

In its report Leading Global Large Scale Solar PV Developers July 2022-June 2023, Mercom has included developers that have a presence in at least 2 countries with projects of 1 MW and above. Overall, 6 out of the 10 project developers on the list are from Europe, 3 from North America and 1 from South Asia.

Capacity expansion is taking place not just organically though, as acquisitions are growing too. During the reporting period, the US had the highest number of project acquisitions of nearly 42 GW out of the 112 GW reported globally. A total of 60.6 GW capacity changed hands during H1/2023, an 18% increase compared to 51.6 GW in H2/2022.

The growth in the pipeline of these large players is also due to countries in Europe developing aggressive solar energy goals to become energy self-sufficient in the wake of the Russian aggression in Europe. Globally, 191 GW new solar capacity came online in 2022 with a 22.1% annual increase, according to the report, led by 86 GW in China.

However, the Uyghur Forced Labor Protection Act (UFLPA) and anti-circumvention investigation in the US pulled back installations by 8.3% YoY. Going forward, installations are likely to get a boost from the US Inflation Reduction Act (IRA).

The report is available for free download on Mercom's website.