A win for Former US President Donald Trump in the upcoming US Presidential Elections in November 2024 is likely to negatively impact the growth of renewable energy in the country according to Wood Mackenzie. Analysts believe a Trump Presidency would abandon the country's 2035 net-zero target for the power sector that practically centers around solar energy.

In a new Horizons whitepaper titled Hitting the brakes: how the energy transition could decelerate in the US, Wood Mackenzie says a Republican victory led by Trump could usher in a delayed energy transition for the US.

Across all 3 outlooks of base case, net-zero and delayed transition scenarios in the report, analysts expect strong growth in zero-carbon power generation in the coming decades. Yet, it is policy environment that will dictate the pace of this growth.

In the delayed transition scenario brought on by a prospective Trump Presidency, the analysis projects the total wind, solar and energy storage capacity in the US at about 500 GW or 25% lower in 2050 compared to its base case.

Instead, coal generation capacity retirement will be delayed by 4 times higher than the base case with 104 GW on the system by 2040, down from about 180 GW in 2024. It could boost natural gas and nuclear power instead to support growing electricity demand from industrial growth driven by data centers and manufacturing reshoring.

There will likely be enhanced investment in fossil fuels as fossil fuel peaking gets delayed, while limited investments in low-carbon energy will slow down.

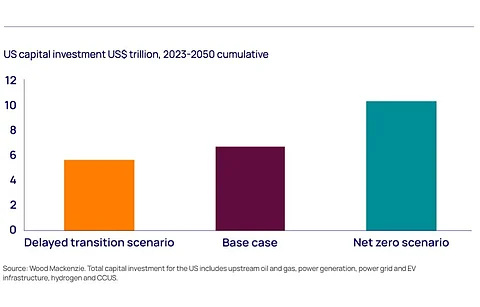

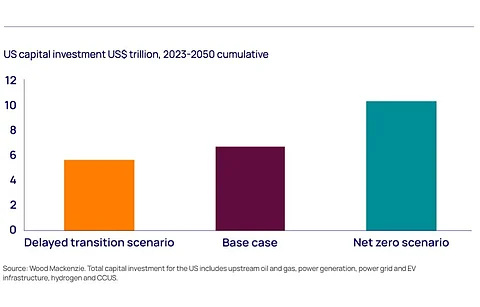

The report projects a $6.5 trillion investment for the energy sector between 2023 and 2050 in its delayed transition scenario, about 55% lower than the $11.8 trillion it sees as required under the net-zero scenario, and $1 trillion less than the $7.7 trillion it expects in the base case scenario brought on by a prospective Trump Presidency. It may also lead to less policy support for low-carbon energy and infrastructure improvements.

The hugely successful Inflation Reduction Act (IRA), which has prompted solar module manufacturing capacity announcements to exceed 125 GW since its passing, may not be entirely repealed but altered, according to the whitepaper.

Wood Mackenzie does not see a complete end to the Production Tax Credit (PTC) and Investment Tax Credit (ITC) under a Republican regime even though it does not rule out the scenario entirely.

A staunch critic of China, the government under Trump may resort to new legislations and trade policies targeting China's dominance of low-carbon supply chain. Tariffs restricting imports will continue including under Section 201. Recently, US President Joe Biden stripped Section 201 tariff protection for imported bifacial solar panels that were imposed by the previous Trump administration (see Bifacial Solar Panels Lose Section 201 Tariff Protection).

"This election cycle will really influence the pace of energy investment, both in the next five years and through 2050," says Director of Wood Mackenzie's Energy Transition Research, David Brown. "Investments in low carbon supply need to be made in the near term to realize longer-dated decarbonization targets. US carbon emissions could grow, putting net zero out of reach in our delayed transition scenario."

Nonetheless, Wood Mackenzie believes state-level policies in the US can continue the momentum for low-carbon investment, independent of federal policy.

"A slower transition scenario for emerging technologies does not mean the story is over," said Brown. "The emerging technology sector in the US will need to reassess costs, project sizes, and subsidy reliance. This should be approached through a position of confidence."

The complete Horizons report from Wood Mackenzie is available on its website.

Wood Mackenzie's Principal Analyst, Distributed Solar, Europe Juan Monge is the keynote speaker on day 2 of the TaiyangNews Virtual Conference on Distributed Solar Optimizing PV Power Supply for Homes & Businesses. Registrations to the 2-day event on May 28-29, 2024 are free and can be done here.