Waaree’s Q1 FY26 revenues rose by over 31% YoY; EBITDA and profit surged over 80% and 90%, respectively

It achieved a record 2.3 GW module production, up from 1.4 GW a year ago; expansion underway in the US and India

Waaree’s board has approved ₹27.54 billion CapEx to expand solar cell and ingot-wafer capacities

It is also investing in green hydrogen, battery storage, and inverter manufacturing to broaden its clean energy portfolio

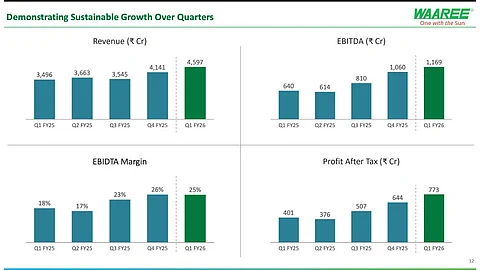

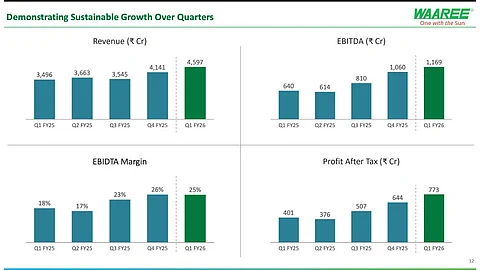

It is a good time to be in the solar PV manufacturing business in India as companies thrive on strong domestic demand. Solar module manufacturer Waaree Energies Limited increased its revenues for Q1 FY2026 (period ending June 30, 2025) by 31.48% year-over-year (YoY) to INR 45.97 billion ($527 million).

The revenue mix was predominantly domestic with a 68% share, with the remaining 32% from overseas.

Its EBITDA for the quarter rose by almost 83% YoY to INR 11.68 billion ($134 million), while net profit over the same period increased by around 93% to INR 7.72 billion ($88.6 million).

During the reporting quarter, Waaree says it achieved its highest-ever production of solar modules at 2.3 GW, attributing it to a strong operational focus. It remains on track to commission additional module manufacturing of 1.6 GW in Texas, US, and 3.2 GW in Chikhli, Gujarat. In Q1 FY25, it produced 1.4 GW.

Its board of directors has approved an additional CapEx of INR 27.54 billion ($315.6 million) for solar cell production capacity expansion by 4 GW in Gujarat, and ingot-wafer by 4 GW in Maharashtra. Currently, the company operates 15 GW of solar module production capacity and 5.4 GW of solar cells (see Waaree Commissions India’s Largest Solar Cell Production Factory).

“On the demand side we have a robust order book of ~₹49,000 crore (INR 490 billion/$5.6 billion) and a global pipeline of 100+ GW, reflecting positive market sentiments across key geographies,” shared Waaree Energies Whole Time Director and CEO Dr. Amit Paithankar. “A strong and sharp focus on costs and profitability is reflected in our financials. We maintain our FY26 EBITDA guidance of ₹5,500 to ₹6,000 crore (INR 55 billion to INR 60 billion/$633 million to $687 million).”

Its order book includes 2.23 GW for Waaree Solar Americas. In total, 58.7% of the orderbook is for the Indian market, while the remaining 41.3% is from overseas. Waaree Energies targets adding 4.8 GW of module capacity during FY26. By FY27, it aims to expand its aggregate solar module production capacity to 25.7 GW, cell capacity to 15.4 GW, and ingot-wafer capacity to 10 GW.

Waaree also shared that its green hydrogen, inverter, and battery energy storage system (BESS) facilities are also under construction. For green hydrogen, it is developing a 300 MW plant in Valsad’s Dungri in Gujarat. The lithium-ion storage cell and energy storage system facility in Valsad’s Rola is scheduled to come online by FY27. For inverters, it aims to bring online its Sarodhi, Valsad factory with an annual capacity of 3 GW by FY26.

Recently, another Indian solar PV manufacturer, Premier Energies Limited, also reported its Q1 FY26 financials with a record quarter underpinned by strong domestic market demand (see Premier Energies’ Q1 FY26 Revenues Grow By Over 12% QoQ).