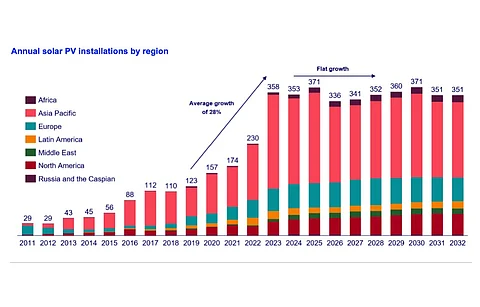

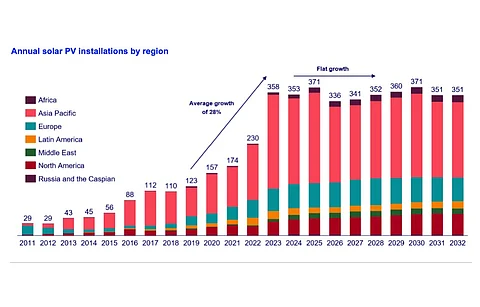

Between 2019 and 2023, the world registered an average annual growth of 28% for solar PV installations, and most recently reported a 56% annual growth in 2023 with 358 GW. Going forward, however, as this market matures, Wood Mackenzie expects growth to become slower. Especially between 2024 and 2028, the average annual growth will be more or less flat.

This is one of the 3 predictions for the global solar market by Wood Mackenzie's Head of Global Solar Michelle Davis.

According to Davis, "Growth in the global solar market is following a typical S-curve. Over the last few years, growth has climbed rapidly up the steepest part of the curve. Starting in 2024, the industry is officially past the inflection point, characterized by a slower growth pattern."

"The global solar market is still many times larger than it was even a few years ago, but it's natural for an industry's growth to slow as it matures," she adds.

The world's largest solar market China is likely to shrink slightly in 2024 as insufficient grid infrastructure investments play spoilsport. The industry also needs more storage capacity. Distributed solar growth will slow down as well with the rollback of subsidies and changes to compensation schemes.

Europe too has seen significant growth of 38% in 2022 and 26% in 2023. Over the next 5 years, the continent is likely to grow by 4% annually, as per Wood Mackenzie.

Since the urgency of the energy crisis has diluted as retail rates declined as much as 40% last year, Davis forecasts a subdued distributed solar segment in several markets of Europe. This is a significant challenge since utility-scale solar growth here is limited by grid infrastructure capacity.

On the other side of the world, the US is forecast to see the full breadth of the Inflation Reduction Act (IRA) materializing. Even then, Davis sees it growing by 6% on an average between 2024 and 2028. This compares to the 27% average growth between 2019 and 2023.

The impacts of the IRA have taken longer to manifest than anticipated, Davis points out. Despite some 120 GW of solar module capacity planned by 2026 post the IRA coming into force, the actual module manufacturing capacity of the US has grown by only a few GWs. Nonetheless, in 2024, the US module manufacturing sector will nearly triple with Wood Mackenzie expecting 40 GW to come online by the end of the year.

Similarly, the pipeline of contracted projects has decreased even though the early-stage utility-scale projects pipeline exceeded 40% since late 2022. Davis says, "It's hard to sign contracts when you don't know the final rules for various incentives."

The good news for the US market is that true benefits of the additional tax credits will finally materialize in more distributed solar installations in 2024.

When it comes to solar PV manufacturing, Wood Mackenzie foresees around 350 GW being installed globally over the next decade. In comparison, China alone has more than 1 TW of solar module manufacturing capacity, 3 times the global demand. Not all of it was utilized fully as the utilization rates dropped from 70% in 2021 to less than 40% in 2023. This oversupply is one of the reasons for the record-low module prices in 2023.

By virtue of its massive vertically integrated manufacturing capacity, China will continue to impact markets like the US and India that are trying to build a domestic supply chain.

Davis expects many planned facilities to inevitably fail to materialize, while existing facilities will be hard pressed to stay in business as utilization rates decline. She points to multiple announcements of cancelled facilities in China over the last several months, impacting margins for manufacturers, reducing some to zero.

"And while 2023 saw a flurry of US manufacturing announcements, 2024 will test which ones have the confidence and financial resources to move forward," sums up Davis. "This is not new – solar manufacturing is known as being a notoriously challenging business. But the sector has also never been this large. With global demand growth slowing, manufacturers will have to be as innovative as ever to remain a going concern."