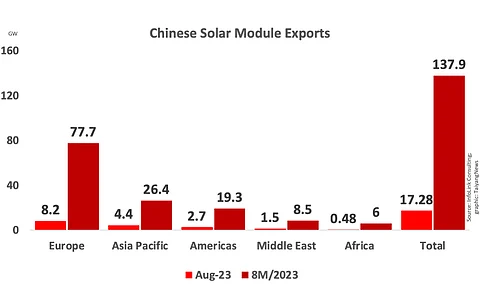

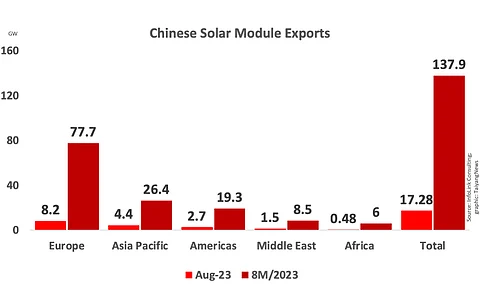

Europe continues to be the largest buyer of Chinese solar modules, taking in 47% of total exports in August 2023, according to the latest analysis of InfoLink Consulting. The continent imported 8.2 GW of panels from China during the month, out of the 17.3 GW the country exported.

Imports to Europe for the month increased from the 15% reported in July 2023, but dropped 5.4% from August 2022. The drop in European demand in Q3 is mainly attributed to the bulging inventory in the warehouses which is likely to spiral down in H2 as well, according to InfoLink analysts. Price declines are likely to narrow in September, with signs of recovery in order deliveries.

They add, "Given the characteristics of the European market, a certain level of rolling inventory will remain on the market next year, but whether this year's high-inventory issue will persist into next year depends on local consumption. Judging from the installation data released by European countries in the first half of the year, an acceleration in installations will be necessary to deplete the inventory accumulated so far this year."

Overall, Chinese solar panel exports in 8M/2023 increased 26.8% YoY to 137.9 GW, out of which Europe bought 77.7 GW reflecting an annual jump of 29.21%. In comparison, Europe imported 86.6 GW of Chinese solar modules in 2022 (see China Exported 154.8 GW Solar Modules In 2022).

Cheaper Chinese modules, and a whole lot of them, in European warehouses are becoming a cause of worry for the local manufacturing industry as the German lawmakers are reportedly contemplating imposing punitive tariffs on imported modules, a move opposed by SolarPower Europe.

Among other markets, Asia Pacific took 4.4 GW of Chinese imports in August 2023—a 109% YoY growth—taking the cumulative in 8M/2023 to 26.4 GW.

India was the largest market as the decline in module prices made sure Chinese modules were still cheaper than domestic product even after the Basic Customs Duty (BCD). India bought 959 MW in the reporting period, and the volume is likely to go up between Q4/2023 and Q1/2024 thanks to postponed projects coming back on track and an exemption from using modules from the Approved List of Models and Manufacturers (ALMM) till March 2024 (see India Provides Relief From ALMM Obligation).

With more than 600 MW capacity, Uzbekistan was the 2nd largest destination for Chinese modules in August this year, followed by other key markets of Japan and Australia. Japan is where demand can be seen shrinking due primarily to limited land availability and floor area restrictions.

Solar module imports for the Americas region went up 18% MoM and 10% YoY to 2.7 GW, reaching a cumulative 19.3 GW in 8M/2023, led by Brazil. Low module prices and shorter payback periods of PV projects led this market as distributed generation grows and ground-mounted projects soar.

With 53% MoM and 73% YoY improvement, the Middle East bought 1.5 GW of Chinese modules, taking the cumulative to 8.5 GW. Demand was led mainly by Saudi Arabia, UAE and Israel.

South Africa led demand in Africa as the continent imported 6 GW capacity in 8M/2023 including 479 MW in August, down 31% MoM and up 85% YoY.

InfoLink expects subdued market demand in H2/2023 thanks to rapid stockpiling of inventory in various regions, especially Europe where Rystad Energy believes Chinese panels could grow to 100 GW DC by 2023-end (see More Chinese Modules For Europe). Module manufacturers may also be revising their shipping strategies and manage inventory more actively to meet their year-end targets.