Chinese PV Import Share In India Up

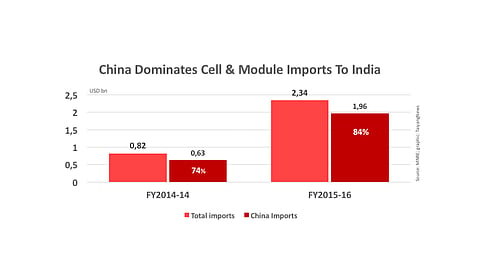

- Chinese modules and cells imported into India in 2015-16 amounted to 84% of the total of $2.34 billion

- In 2014-15, Chinese imports equalled over 74% of the total, though the amount was at $820.95 million much lower

- India's domestic PV cell and module capacity is still small in terms of output when compared to the country's ambitious plan of installing 100 GW of solar by 2022

India imported a total of $2.34 billion worth solar cells and modules in 2015-16. Out of this, $1.96 billion came from China alone, a signal of the growing role of Chinese players in the Indian PV market. The Minister for New and Renewable Energy (MNRE), Piyush Goyal informed the Indian Parliament.

This is a sharp increase from Chinese cells and modules imported in 2014-15 worth $603.34 million, out of the total imports of $820.95 million in that category.

India is chasing a huge target of 100 GW of solar power capacity installation by 2022, which looks pretty daunting considering it has a current installed solar power capacity of just over 8.7 GW. It added 5.8 GW PV in the past 2.5 years (see India Adds 14.3 GW Renewables).

Its domestic manufacturing capacity remains low vis-à-vis the national target. The installed solar cell capacity on June 30, 2016 was 1,468 MW, while the operational capacity was only 1,123.05 MW. The module capacity was a tad higher at 5,848 MW, but the operational module capacity was only 4,307.55 MW, according to MNRE.

In August 2016, clean energy consultancy Bridge to India reported that Chinese module suppliers have increased their share in the Indian solar PV market to 75% in the last 12 months, up from 50%. Chinese module manufacturer Trina Solar announced it crossed 1 GW of shipments to India in June 2016.

Out of the 10 top module suppliers in the Indian PV market, at least eight were from China, with the only Indian company being Waaree Energies Ltd. First Solar from the US was the only western module supplier in this group, according to MNRE.

.png?w=50&fm=png)