Before the confusion and hullaballoo around India's safeguard duty has come to an end, the Indian Director General of Trade Remedies (DGTR) has introduced another idea to keep the solar market from finding rest – this time it is recommendations for imposing anti-dumping duty (ADD) on imported Ethylene Vinyl Acetate (EVA) from China, Malaysia, Saudi Arabia and Thailand.

South Korea has been left out of the ambit of this ADD as DGTR found imports from this country come as EVA resins which is a raw material for the EVA sheets.

An important element of a solar module, EVA sheets act as glue to keep glass, cells and backsheet together and protect the solar cells from mechanical stress.

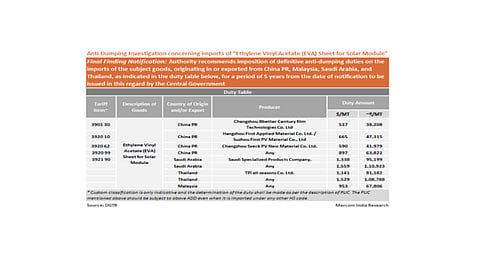

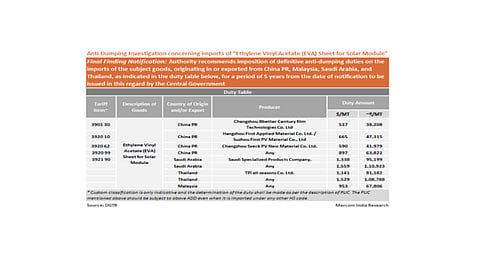

The DGTR recommends imposing ADD in the range of $537 to $1,559 per metric ton (MT) for a period of 5 years. Duty rates are applicable for exports of subject goods manufactured by specified producers, and the customs would need to verify the name of the producer at the time of clearance of subject goods, it stated. The Central Government will decide when the duty will come into force.

Background

The Directorate General of Anti-Dumping and Allied Duties (DGAD), which is now called DGTR, initiated investigations into EVA sheets being dumped into the country for products coming from China, Malaysia, Saudi Arabia, South Korea and Thailand (see India Investigating EVA Dumping).

A petition was filed by Indian manufacturer RenewSys India Private Limited that claimed that it was among 4 and only domestic producers of this product in the country. The other three were stated as Vishakha Renewables Pvt. Ltd., M/s Allied Glasses Pvt. Ltd. and Ms. Brij Foot Care.

During the course of the investigation from October 1, 2016 to September 30, 2017, DGTR found that the market share of the domestic industry reduced from 68% in the base year to 28% during the said period, while imports from the subjected countries increased from 24% in the base year to 60%.

However, opposing views noted by the agency claim the domestic industry is operating at only 25% capacity utilization and producing only 4,151 MT against the total demand of 10,396 MT. This gap in demand and supply has increased the inflow of EVA from China et al.

DGTR's EVA recommendations follow its proposal to impose $114.58 per MT ADD for 5 years on textured tempered glass imported from Malaysia (see Anti-Dumping Duty For Malaysian Solar Glass).