As supply chain difficulties ease and manufacturing picks up, European solar power purchase agreement (PPA) prices are starting to go down with the region experiencing the 1st drop in 2 years, whereas in North America prices continued to go up for 2 consecutive years as Inflation Reduction Act (IRA) is assessed by developers while dealing with a complex supply chain environment, according to LevelTen Energy.

Europe

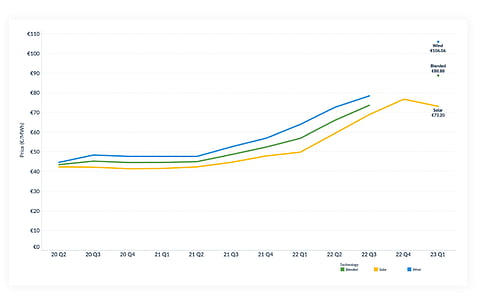

A total of 5.2 GW corporate PPAs were signed in Europe in the reporting quarter, compared to 4.6 GW in Q4/2022. According to LevelTen's 25th percentile (P25) index of solar prices, the average dropped slightly QoQ by 4.7% to €73.20/MWh but increased 47% YoY and 76% higher than in Q1/2021.

Solar PPA prices declined for all European markets, according to the analysts barring Spain which was the region's most active market. Here, prices went up 9.8% QoQ and 32.2% YoY. This market sustained competitive thanks to high competition pushing up prices. As more supply is set to come in after Spain approved 27.9 GW solar and wind capacity earlier this year, the country may see PPA prices coming down in Q2/2023 (see 27.9 GW Renewables Projects Move Forward In Spain).

Apart from Spain, analysts count Greece as an attractive market for solar PPAs as the country gives priority to projects having a PPA, in the interconnection queue.

For the rest of Europe, LevelTen's Senior Energy Analyst Placido Ostos sees drop in natural gas and wholesale electricity prices as pressuring solar developers to decrease their PPA prices.

Ostos also added, "A primary driver is the fact that supply chain difficulties brought by the pandemic are abating as manufacturers ramp up production and logistical challenges resolve. Also, the gradual decline in inflation, although compensated by higher interest rates, is providing developers with improved visibility into their capex costs, which means fewer uncertainties to factor into PPA prices."

Wind prices for Europe continued to rise, up 35% over the last 6 months, as the industry faces permitting barriers and rising costs. Together, LevelTen's overall index of wind and solar PPAs across Europe rose 56% YoY to €88.88/MWh.

Further boost to PPAs is expected from the European Commission's (EU) final energy market reform proposal that encourages developers to go for corporate PPAs.

"If tenders follow the Commission's guidelines, then project developers will be incentivized to enter into a PPA with small and medium enterprises so that they can become more competitive in public tenders," said Ostos.

North America

In North America, the average increase in P25 PPA offer prices went up 6.6% to $50.32/MWh. For solar, the prices climbed 8.5% to $49.52/MWh and for wind the increase was 4.9% to $51.12/MWh.

Vice President of Energy Marketplace at LevelTen, Rob Collier explained, "Developers are working to understand what impact the Inflation Reduction Act (IRA) will create on PPA prices, and at the same time, they are processing how new federal and local policies will affect their business. These factors, coupled with a complex supply chain environment and rising capital costs, contribute to pricing showing a mixed picture."

Benefits and changes to come in under the IRA are still evolving which is creating uncertainty for the market. State and regional regulatory changes too add to the same for instance, as LevelTen points out, ERCOT's Performance Credit Mechanism (PCM) is being seen as a promoting natural gas.

Both the reports can be purchased from LevelTen's website.