Ongoing uncertainty regarding clean energy tax credits in the US led to $1.4 billion worth of projects being cancelled in May 2025

The OBBA proposal threatens tax credits, shaking investor confidence across the solar, EV and battery sectors

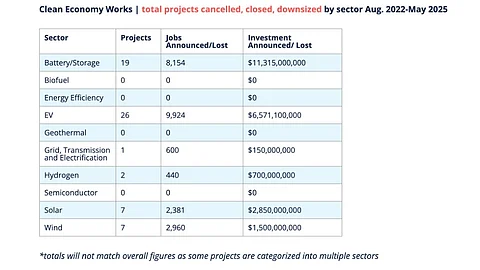

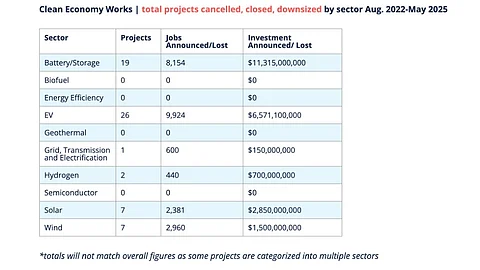

Between January and May this year, E2 says clean energy projects worth $15.5 billion, with 12,000 potential jobs, have been withdrawn

Continued policy uncertainty regarding clean energy tax credits and anticipation of higher taxes has resulted in the cancellation of planned US clean energy investments worth over $1.4 billion in the month of May 2025, according to a new report from independent business advocacy group E2.

The monthly analysis from E2 and Clean Economy Tracker identifies the latest cancellations as spanning battery, electric vehicle (EV) and solar panel factories in West Virginia, New York, Alabama, Arizona, and Washington. It includes Meyer Burger’s Arizona factory (see Meyer Burger Shuts Down US Solar Module Factory).

These cancellations in May 2025 expand the volume of total cancellations since January this year to $15.5 billion as the US market reels with continued policy uncertainty regarding clean energy tax credits promised under the Inflation Reduction Act (IRA). It directly cancels nearly 12,000 new jobs these projects could have created (see US Policy Uncertainty Stalls $14B, 10K Clean Energy Jobs).

Most impacted are the Republican congressional districts with more than $9 billion in investments and almost 10,000 jobs cancelled in 2025.

Analysts attribute the rising volume of cancellations to increasing ambiguity in the implementation of federal clean energy tax credits, which has begun to affect business confidence and project timelines under the Inflation Reduction Act (IRA).

The Trump administration’s proposed One Big Beautiful Bill (OBBA) is on its way to the Senate, where its fate will be decided, most probably by July 4, 2025. The industry had been hoping that the House-passed version of the bill would undergo positive changes for the sector before it reaches the Senate, but things don’t seem to be changing much. The Senate will return the bill to the House after the vote.

In its recent recommendations for OBBA, the US Senate Finance Committee’s proposals dealt a blow to the residential segment as it demands Investment Tax Credit (ITC) under Section 25D to be repealed within 180 days of the bill being imposed as an act (see US Senate Finance Committee Proposal Risks Clean Energy Tax Credits).

“Businesses are reacting to the Senate’s proposal—like the House’s— that would drastically scale back the very tax credits that had been driving an American energy and manufacturing boom,” explained E2 Communications Director Michael Timberlake.

He added, “These cancellations are just the first shoe to drop. With renewable energy supplying more than 90 percent of new electricity in America last year, canceled projects will likely mean less available energy and higher electricity prices for consumers and business alike.”

Nevertheless, amidst the cancellations, announcements were made for nearly $450 million in new investments in solar, EV and grid and transmission equipment factories across 5 states in May 2025.