Stricter US construction-start rules could cut solar installations by around 60 GW by 2030, warns CEA

Trump’s executive order may bring tighter Treasury rules, tariffs, and more hurdles for developers

On the other hand, CEA says workable rules could enable H1 2026 safe harboring, boosting US solar by 60 GW

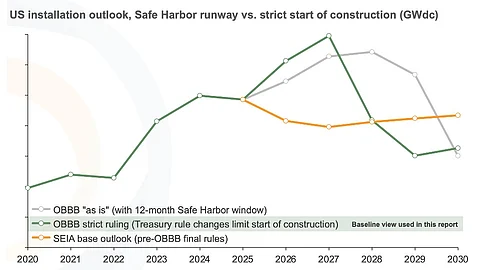

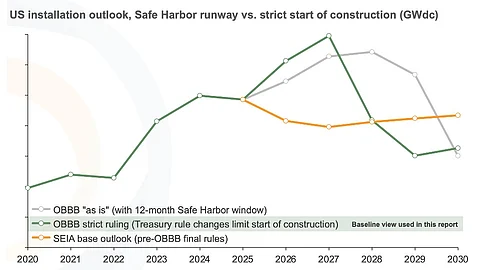

A Clean Energy Associates (CEA) report cautions that new, stricter construction-start rules may limit US solar projects to volumes secured before July 2025. The firm estimates this could reduce cumulative installations by around 60 GW by 2030.

Through the One Big Beautiful Bill Act (OBBBA), the US government has sent solar developers rushing to place their projects under construction by July 4, 2026, or place these in service by December 2027 to secure clean energy tax credits.

Yet, the uncertainty regarding any possible stricter rules from the Department of the Treasury, as instructed by US President Donald Trump in his executive order, may just disrupt the market further, according to the CEA. The Treasury is expected to hand in its recommendations by August 18, 2025 (see Trump Signs Executive Order To End Green Energy Subsidies).

“If the start of construction rules are workable for developers, then H1 2026 Safe Harboring could push US installations along a higher glide path, adding 60 GW of installations through 2030 compared to the base case assumptions,” adds CEA in its latest report.

Yet again, CEA analysts believe Trump could push for punitive tariffs on equipment and have the Treasury revise qualification methods or put in place additional requirements for project developers.

The ball has already started rolling in this direction as the US launched a national security review into polysilicon imports under Section 232, which Wood Mackenzie termed as the biggest challenge for the US solar market (see Wood Mackenzie Calls Section 232 US Solar’s Biggest Challenge).

Since the US cell makers currently rely heavily on Chinese wafer suppliers, they also stand to lose this link due to the US government’s Foreign Entity of Concern (FEOC). It will drive up prices, which CEA expects cell makers to pass on to module makers and end buyers.

TaiyangNews will explore the US solar market in view of the regulatory shifts at the upcoming RE+ 2025 event in Las Vegas, US. It is co-organizing the 2025 Solar Made in USA summit in collaboration with RE+ and EUPD Research. To be held on September 8, 2025, it will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing and future strategies for the players in light of the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.