PV and energy storage industry research firm InfoLink Consulting has released its H1 2025 ranking of the top 5 solar cell manufacturers by shipments – Tongwei Solar, SolarSpace, Yingfa Group, Jietai Solar (JTPV), and AIKO. The ranking considers only solar cells sold externally and excludes cells used internally by vertically integrated module manufacturers.

According to InfoLink, the combined shipments of the top 5 reached 87.8 GW globally in H1 2025, up about 12.5% year-on-year. TOPCon cells accounted for 88.3% of the total, PERC 11.2%, and BC cells less than 1%.

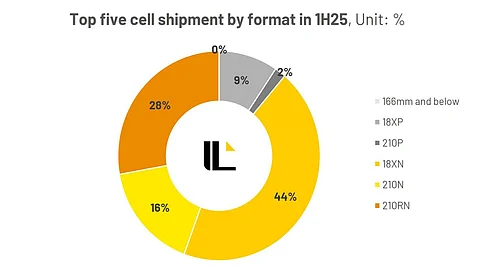

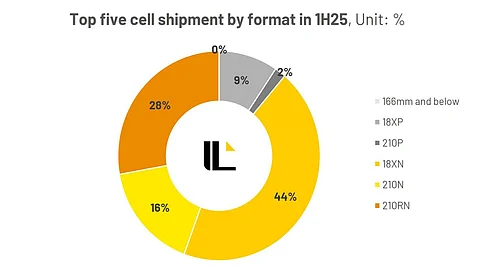

By wafer size, 18x cells (182-182.2 mm / 182-183.75 mm) shipments totaled around 46.9 GW, 210R cells 24.3 GW, and 210 mm cells about 16 GW.

The top 5 suppliers remain unchanged from 2024 (see Top 5 Solar Cell Suppliers Shipped 163 GW Capacity In 2024).

Shandong Railway Investment Holding Group, a major Chinese state-owned enterprise in railway construction, operation, and management, has established a wholly owned subsidiary, Shandong Railway Energy Investment Group Co., Ltd. It has a registered capital of RMB 10 billion ($1.39 billion) and will focus on green energy investment and operations.

The new company aims to consolidate a series of renewable energy assets previously under the parent group, including 41 wind, solar, and storage power stations with a total installed capacity of 1.8 GW, of which 1.7 GW is already grid-connected. In the long term, it aims to leverage ‘transportation + energy’ application scenarios to develop a full-chain business covering wind, solar PV, and nuclear power generation; energy storage; and consumption.

Chinese power and energy developer Guangzhou Development Group has announced the winning candidates for its centralized solar PV inverter procurement for 2025-2026, totaling 800 MW.

Lot 1 involves 200 MW of centralized inverters with rated output power of 3,125 to 3,300 kW. Kehua Digital Energy, with a bid price of RMB 0.071/W, Kstar with RMB 0.073/W, and Sineng Electric with RMB 0.073/W have been named the winners for this lot.

Lot 2 awarded 600 MW of string inverters with rated AC output power of 175–320 kW. CNBM Xinyun Zhilian at a bid price of RMB 0.105/W, Sineng Electric at RMB 0.093/W, and TBEA at RMB 0.092/W have been named the winners of Lot 2.

The one name to figure in both lots, Sineng Electric, received a Customer Testing Facility accredited laboratory certificate from TÜV SÜD (see China Solar PV News Snippets).

The Shandong Provincial Development and Reform Commission has recently issued several policy documents to advance the market-based formation of feed-in tariffs (FiTs) for renewable energy. Part of these are China’s first set of bidding rules for the contracts for difference (CfD).

According to the terms, all electricity generated from wind and solar projects in the province should, in principle, be traded in the power market, with prices set through market transactions.

The province has allocated a total CfD volume of 9.467 billion kWh for the first bidding round, including 8.173 billion kWh for wind power and 1.294 billion kWh for solar PV. The bidding price cap for both wind and PV is RMB 0.35/kWh, while the floor is set at RMB 0.094/kWh for wind and RMB 0.123/kWh for PV. The mechanism tariff will apply for 15 years for deep offshore wind projects and 10 years for other projects.