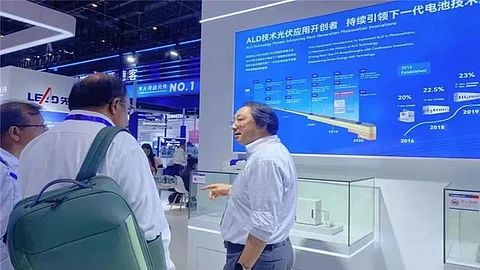

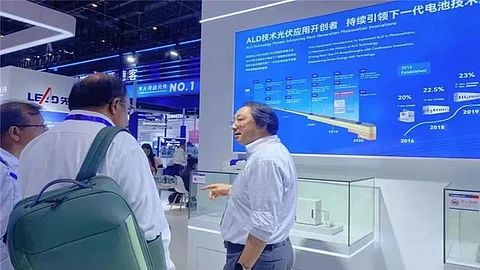

Chinese semiconductor and solar cell equipment manufacturer Leadmicro has received regulatory approval from the China Securities Regulatory Commission (CSRC) to issue convertible corporate bonds to unspecified investors. The proceeds, capped at RMB 1.17 billion ($162.5 million), will primarily fund the construction of a smart manufacturing facility for thin-film deposition equipment and the expansion of its R&D lab. According to its fundraising prospectus released in November 2024, RMB 642.8 million ($89.3 million) of the funds will be allocated to the factory, which will produce deposition tools mainly for solar cell and semiconductor wafer manufacturing.

In February, Leadmicro announced the first shipment of its new in-house developed Edge Passivation 2.0 equipment, aimed at the half-cut solar cell application (see China Solar PV News Snippets).

Chinese solar encapsulation materials maker HIUV has announced the cancellation of its Phase I of its 200 million m2 PV encapsulation film facility in Pinghu, Zhejiang Province. Originally planned with a total investment of RMB 459.14 million ($63.8 million), of which RMB 319 million ($44.3 million) was to be raised through a public offering, the plant was scheduled to come online by Q3 2025. HIUV cited weakened downstream demand and an oversupplied encapsulant market as the reason for the termination. RMB 99.91 million ($13.9 million) had already been spent. The remaining RMB 226.03 million ($31.4 million) will be redirected toward a new automotive industry-focused PDCLC smart film facility.

Solar cell and module manufacturing arm of GCL Group GCL System Integration (GCL SI) has forecast a net loss of RMB 250 million ($34.7 million) to RMB 350 million ($48.6 million) for the first half of 2025. This is a swing from a net profit of RMB 43.33 million ($6.03 million) in the same period last year. The company attributed the decline to industry-wide price compression amid supply-demand imbalance across the PV value chain, despite a surge in China's solar installation capacity. GCL SI noted it ranked 3rd in terms of winning capacity in large-scale central SOE bids, with significant year-on-year growth in module shipments.

GCL SI was recently named as one of the winners of a Huadian New Energy’s module procurement tender (see China Solar PV News Snippets).

China’s State Administration for Market Regulation and the Ministry of Industry and Information Technology (MIIT) have jointly released the Action Plan for Metrology to Support the Development of New Quality Productive Forces (2025–2030). The plan identifies renewable energy as a priority area and includes a focus on developing key metrology technologies such as solar PV module lifetime assessment, virtual power plant evaluation, carbon capture, heat consumption measurement, and carbon emission accounting. It also aims to establish intelligent metrology and safety testing platforms to support collaborative development across solar, wind, hydrogen, nuclear, and other renewable sectors.