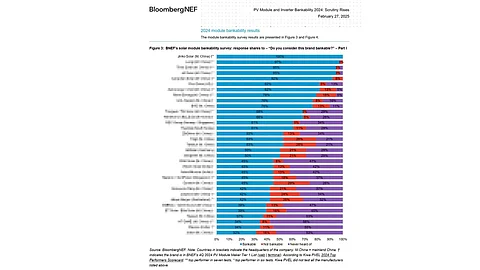

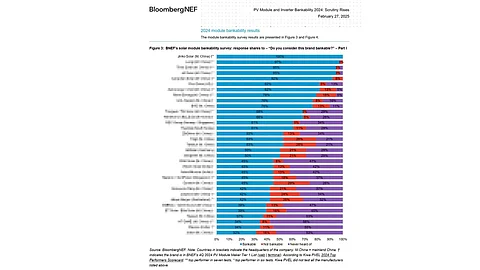

According to its latest release, leading vertically integrated solar and ESS manufacturer JinkoSolar has become the ‘only’ solar company to receive 100% bankability recognition in BloombergNEF’s 2024 PV Module Bankability Survey. The company says this is the 10th consecutive year that it has been named the PV industry’s most bankable brand. The ranking is based on financial stability, product reliability, and market performance. JinkoSolar outperformed 66 competitors, with total module shipments of over 300 GW and the Tiger Neo series accounting for more than half of it. The company plans to expand research in solar and storage solutions, reinforcing its role in the global clean energy transition.

Last month, JinkoSolar also announced its inclusion in S&P Global’s Sustainability Yearbook 2025 (see China Solar PV News Snippets).

The Meishan Municipal Bureau of Ecology and Environment has approved Tongwei Solar’s environmental impact assessment (EIA) report on the expansion of its solar cell manufacturing base. According to the report, Tongwei plans to expand its existing Phase IV high-efficiency solar cell project in Meishan City, Sichuan Province, by adding production equipment, adjusting operational frequencies, and improving the photoelectric conversion efficiency through process optimization. With an estimated investment of RMB 1.6 billion ($219.18 million), this expansion will increase the facility’s solar cell production capacity by 8 GW annually to 52.5 GW.

Recently, Tongwei commenced construction on a 350 MW wind-solar-storage integrated green electricity silicon production project in Baotou, Inner Mongolia (see China Solar PV News Snippets).

Solar PV manufacturer Canadian Solar has reported annual revenues of RMB 46.16 billion ($6.32 billion) for FY2024, down 10.03% year-on-year (YoY). Its net profit attributable to the parent company of RMB 2.29 billion ($313.83 million) was down 21.09% YoY. The company stated that it strategically prioritized profitability over shipment volume in 2024, resulting in lower revenue but maintaining profitability despite widespread industry losses. Canadian Solar’s previously accumulated large-scale energy storage projects and contract backlog have entered the fulfillment stage, driving energy storage shipments to 6.5 GWh in 2024, marking a 505.28% YoY increase. The company expects its large-scale energy storage shipments to further grow to 11-13 GWh in 2025, continuing its strong upward trajectory.

Lithium battery and solar cell production equipment manufacturer LEAD has announced the successful rollout of a 100 MW perovskite coating machine for a leading Chinese perovskite cell company. The company stated that its self-developed, wide-format perovskite planar coating equipment is designed for perovskite cell production and pilot lines, capable of precision slot-die coating for perovskite layers, modification layers, and other functional layers. The system ensures uniform large-area coating while maintaining a fast-coating speed of over 50 mm/s. Additionally, it features an integrated vibration isolation platform to ensure process stability.

Last month, LEAD abandoned its plan to issue GDRs on the SIX Swiss Exchange (see China Solar PV News Snippets).

The New Energy Consumption Monitoring and Early Warning Center released data on renewable energy grid integration and consumption across provincial regions for January 2025. According to the data, China’s January photovoltaic utilization rate was 94.4%, while wind power utilization was 94.8%, compared to 95.1% and 95.3%, respectively, in December 2024. 5 provincial regions achieved a 100% photovoltaic utilization rate, including Shanghai, Zhejiang, Hunan, Chongqing, and Fujian. However, utilization rates in Tibet (66%), Gansu (87.2%), Shanxi (88.9%), and Xinjiang (89.2%) were below 90%.