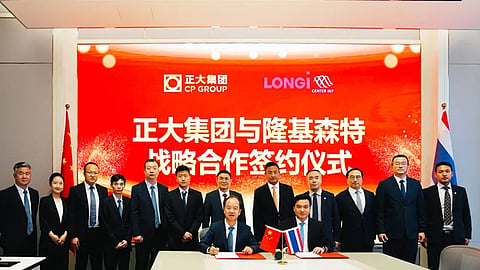

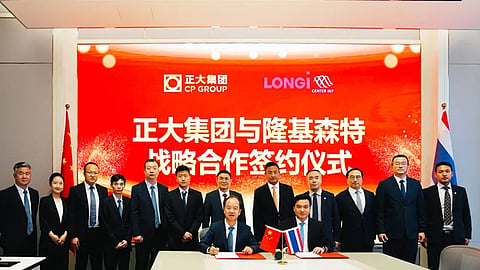

LONGi-Center Int, a building-integrated photovoltaic (BIPV) brand jointly established by LONGi and Center Int Group, has signed a strategic cooperation agreement with CP Group, a diversified multinational conglomerate. Under the agreement, LONGi-Center Int will provide CP Group with one-stop services, including BIPV construction for new and existing factory rooftops, integrated PV + storage + charging projects, and comprehensive energy management. This includes the development and operation of BIPV projects for new buildings, rooftop PV retrofits for older facilities, and integrated solar, storage, and charging solutions.

Solar cell, electronics, and semiconductor equipment manufacturer RoboTechnik has announced plans to issue H-shares and list on the Hong Kong Stock Exchange (HKEX). The company said the listing aims to accelerate capacity expansion, enhance global service capabilities, strengthen its globalization strategy, improve overseas financing channels, and boost overall competitiveness. The company has not disclosed further details.

According to RoboTechnik’s H1 2025 report, its revenues for the first half of the year fell sharply by 65.53% year-over-year (YoY) to RMB 248.54 million ($34.6 million). The company reported a net loss, excluding non-recurring items, of RMB 62.83 million ($8.75 million) in H1 2025, compared to a net profit of RMB 53.96 million in the same period last year. RoboTechnik attributed this decline to cyclical headwinds in the PV industry, reduced market demand, and a corresponding contraction in revenue and cost scale.

Energy storage manufacturer Sigenergy has topped out its mass production base for smart solar-storage-charging systems in Nantong, Jiangsu Province. The RMB 500 million ($69.7 million) project will include production workshops, an R&D and design center, warehouses, an office complex, and supporting facilities, building a modern smart factory focused on mass production of PV inverters, residential storage PACKs, C&I storage PACKs, and Gateway backup systems. Once operational, the facility is expected to produce over 300,000 inverters and storage PACK units annually. Construction began in May 2025, and the structural topping-out milestone has now been achieved.

In July, Sigenergy jointly released a white paper with Intertek, which offers a systematic review of the development potential and safety challenges facing the C&I energy storage market (see China Solar PV News Snippets).

The China Electricity Council (CEC) recently organized the 2024 National Solar PV Power Plant Operation and Performance Benchmarking initiative, a widely recognized evaluation program that assesses the overall performance of PV power plants in terms of operations, energy efficiency management, and reliability. JA Smart Energy, the solar and storage solutions subsidiary of JA Solar, received awards for 4 centralized PV power plants, earning one 4A and three 3A ratings.

China Energy Investment Corporation (CHN Energy) released its China Energy Outlook 2025–2060 report in Beijing. The report forecasts China’s total energy consumption to grow steadily over the next decade, reaching 7.1 to 7.2 billion tons of standard coal equivalent by around 2035, about 20% higher than current levels. The energy mix is projected to undergo a sustained green transition, with non-fossil fuel energy sources accounting for about 35% of total consumption by 2035 and 80% by 2060.

The country’s energy-related carbon emissions are expected to peak before 2030, within a range of 11.4 to 11.6 billion tons. By 2035, carbon intensity (CO2 emissions per unit of GDP) is projected to drop by over 45% compared to 2020 levels. A combination of fossil fuel reduction, large-scale CCUS deployment, and forest carbon sinks is expected to help achieve carbon neutrality by 2060.