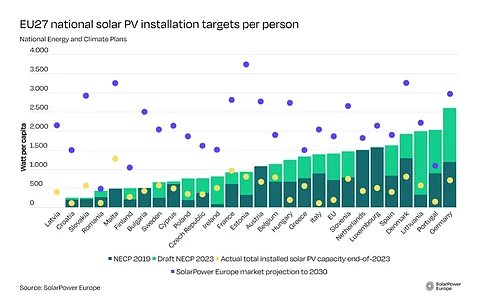

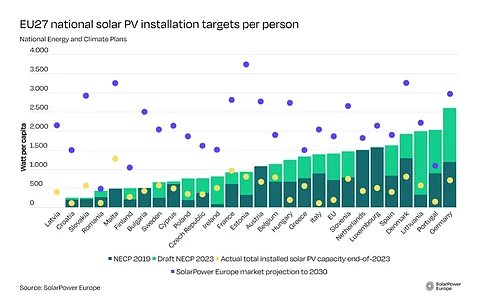

The solar energy targets of European Union (EU) member states as mentioned in their updated National Energy and Climate Plans (NECP) have increased by 87% since 2019, but it is grid issues that threaten the bloc's energy transition, says SolarPower Europe (SPE).

Out of 27 EU member states, 26 have submitted their revised NECPs. Austria is the only one left, as its plans are on hold indefinitely.

At the current rate of ambition, if extrapolated to all member states, this will result in a 555 GW to 626 GW total ambition by 2030. This falls short of the EU Solar Strategy target of 750 GW and the industry potential of 902 GW.

Lithuania and Ireland have multiplied their respective targets by more than 5 and 10, respectively.

Poland follows next, having multiplied its target by 3, while Finland, Portugal, Slovenia and Sweden have more than doubled their targets since the last NECP. Spain increased its target by 95%.

However, SPE says these NECPs do not reflect the investments needed for grid deployment, flexibility and digitalization. For instance, even though several NECPs mention flexibility, only Belgium, Bulgaria, Cyprus and Croatia provide a real target for demand-side flexibility. The 4 countries have plans to add smart-meter roll-out or demand-side response.

Only 9 nations have dedicated targets in terms of MW or MWh or euros for energy storage. Belgium, Greece, Lithuania and Portugal have dedicated targets for batteries, small-scale storage or storage at the household level. Nonetheless, most of them do not provide any concrete plans to use renewables 24×7.

"This demand-side gap risks discouraging citizens' adaptation to the new energy reality. Europeans should be supported to flex their energy use sensibly and consume electricity when it is abundant – like charging e-vehicles in the middle of the day," say SPE analysts.

The association argues that demand-side tools must be included in the NECPs as these can ease pressure on the grid and support the system to add more renewables. It explains, "Demand-side flexibility means less investment is needed for slow-to-build grid infrastructure."

It will surely put pressure on the electricity grid for which these nations need to invest in their grid, but only France and Malta have partially acknowledged that high-voltage level investment is needed at the transmission level.

SPE's Senior Policy Advisor Jonathan Bonadio said, "Europe risks putting the cart before the horse. Energy system planning needs to be in sync with energy generation targets. Without proper energy system planning, solar projects will be held up, solar energy will be wasted, and the business case of solar will be undermined."

The complete country-by-country analysis of the NECPs by SPE is available on its website.