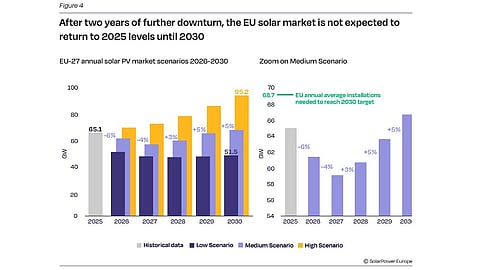

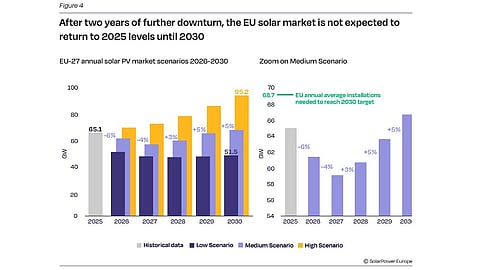

The EU is projected to add 65.1 GW of solar in 2025 – a 0.7% YoY drop – marking its first annual decline since 2016 and the start of a multi-year slowdown

SolarPower Europe says the bloc needs 68.7 GW annually to reach 750 GW by 2030, but both low (664 GW) and medium (718 GW) scenarios fall short

Rooftop demand is weaker than expected as electricity prices have fallen, and policy urgency has eased

It calls for stronger measures on electrification, flexibility, permitting, rooftop support, and EU-based manufacturing incentives

The European Union (EU) is expected to exit 2025 with 65.1 GW of solar PV additions, contracting 0.7% year-on-year (YoY) and marking its first year of annual decline since 2016. SolarPower Europe (SPE) believes this marks the beginning of a long period of decline, as it sees the market recovering to reach 2025 levels only by the end of this decade.

SPE’s 65.1 GW expectation for the market is higher than its previous forecast of 64.2 GW for the market (see SolarPower Europe: European Union To Install 64.2 GW PV In 2025).

In the latest edition of the EU Solar Market Outlook 2025-2030, SPE says the bloc needs to add an average of 68.7 GW annually to reach the 2030 solar target of 750 GW. However, analysts expect 2 more years of decline, anticipating a 6% YoY drop in installations in 2026, 4% in 2027, before picking up with a 3% increase in 2028.

In the low scenario, the EU is projected to reach a combined capacity of 664 GW by the end of 2030, while reaching 718 GW in the medium scenario, missing the target in both scenarios. In the high scenario predicted in the report, the bloc may exceed its actual target, reaching a total of 810 GW. This is the only scenario consistent with meeting the 2030 ambition, they add.

“This gap reflects the combined impact of softer rooftop demand, insufficient flexibility, regulatory uncertainty, and ongoing land-use and permitting constraints, all of which limit the pace at which new capacity can be added throughout the second half of the decade,” reads the report.

Among the reasons that are responsible for the market contraction in 2025 are a decline in conventional electricity prices, the diminishing sense of urgency to install solar, and a waning policy focus. Rooftop solar demand also dropped lower than expected in major markets.

“The contraction should be seen as a worrying warning sign for policymakers: failure to swiftly address the root causes of this market decline threatens to derail progress toward the EU 2030 solar target and seriously risks undermining EU decarbonisation, competitiveness, and energy security ambitions,” point out the analysts.

Leading the markets this year is Germany, which is expected to end the year with 17.6 GW capacity, with a huge gap to Spain, which is next with 9.2 GW. France climbs up to 3rd place on the top 10 EU solar PV markets list this year, with an expected 6.7 GW, thanks to strong commercial and utility-scale expansion. Italy’s annual installations will likely decline to 5.2 GW compared to 6.1 GW last year, reflecting the impact of the phase-out of support schemes. Poland, too, will report an annual drop, adding 3.7 GW compared to 4.1 GW last year. Romania and Bulgaria enter the top 10 this year.

“Solar is now delivering for Europe; 13% of Europe’s electricity was solar powered in 2025. In June we provided the most power out of all other sources in the EU. It's critical that policymakers now implement robust frameworks for electrification, system flexibility, and energy storage to ensure solar leads Europe’s energy transition for the rest of this decade,” said SPE CEO Walburga Hemetsberger.

The report writers offer a series of recommendations to overcome the barriers at the EU-level, ranging from boosting electrification and flexibility, to the right policy frameworks and improving permitting procedures, boosting the rooftop solar market, which can bring the deployment figures back on track. These measures can also make solar supply chains more sustainable and resilient, according to SPE.

Michael Schmela, SPE’s Executive Advisor and Director of Market Intelligence, said, “A clear, simple definition of EU preference based on the production location, and a clear verification scheme are essential to avoid bureaucratic complexities and a fragmented application across Europe.” He added, “We call for a Solar Manufacturing Facility, similar to the Battery Booster, with production-linked incentives based on CAPEX and OPEX. The EU cannot solely rely on a demand-pull strategy, supply-side financing measures are equally important.”

The complete report can be downloaded for free on SPE’s website.