As solar module prices hit record-lows in Europe, thanks to cheaper-priced products from Chinese players, the continent may hear of more companies going bankrupt unless the European Commission (EC) takes immediate action to save its strategic tech supply lines, warns SolarPower Europe (SPE).

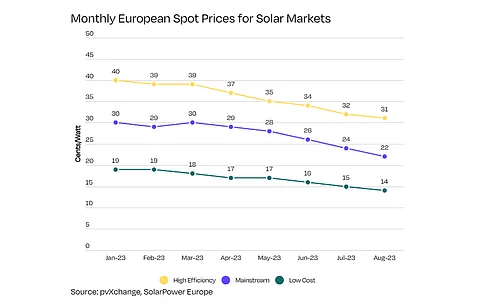

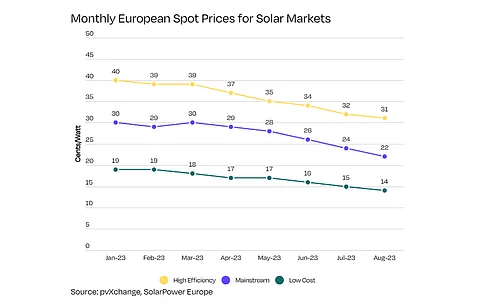

Solar module prices for low-cost products in Europe dropped to a 'record' low of less than €0.15/W in August 2023—over a 25% drop since the beginning of this year, going under even pre-Covid levels, making it difficult for local producers to compete.

In a letter to the commission, the SPE says low prices for modules are a combination of strong global demand and fierce competition between Chinese suppliers.

Industry giants in China rely on government support and relaxing policies to quickly set up their factories, with greenfield module plants in the Asian nation taking up to 2 years to come online. Elsewhere in the world, an upstream PV production plant will take nearly a decade to be commissioned.

Funding from the Chinese government and relaxing policies cushion Chinese investments, but in the absence of a strong support system in Europe, solar manufacturers are feeling the heat. Norway-based solar wafer start-up Norwegian Crystals has already filed for bankruptcy, while its compatriot and another wafer manufacturer NorSun has temporarily shuttered its Årdal plant and laid off staff (see European Solar Wafer Manufacturer In Trouble).

"While declining costs is typically welcome news for accelerating a cost-effective energy transition, it is also creating a deeply precarious situation for European solar PV manufacturers which were building up their manufacturing capacities encouraged by the broad political support for reshoring a European PV value chain," reads the letter.

The association is now demanding the commission to take some urgent steps in the following manner:

SPE CEO Walburga Hemetsberger stated, "This is a rare second chance. Europe's original solar manufacturing base was lost a decade ago. If we don't respond rapidly and appropriately to this price crisis, we're looking at another wave of bankruptcies, and a false start for EU's open strategic autonomy agenda."

The association offers a detailed analysis of the problems European companies are facing with stiff price competition in the market in a report titled Saving European Solar Manufacturing—Call for Action to support Europe's nascent solar industry in times of oversupply and low prices. The report is available on SPE's website.