More than 320 US solar and wind projects are at financial risk due to accelerated federal tax credit phase-out

Developers are under pressure to start construction by July 2026 or forfeit critical PTC and ITC eligibility

Compressed timelines and FEOC rules strain project procurement, financing, and interconnection schedules

Rising federal oversight and lack of clear safe harbor guidelines deepen uncertainty both for developers and investors

As per a new analysis by FTI Consulting, over 320 proposed solar and wind projects – representing more than 100 GW of combined capacity – are at significant financial risk in the US. This is due to the One Big Beautiful Bill Act (OBBBA), which accelerates the phase-out of key federal tax incentives, including the Clean Electricity Production Tax Credit (PTC) under Section 45Y and the Investment Tax Credit (ITC) under Section 48E.

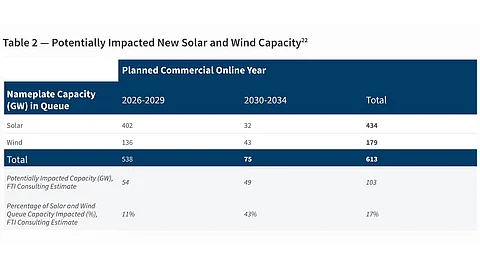

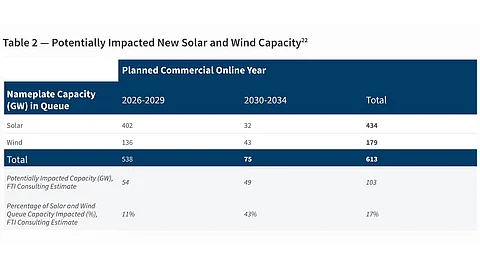

Referring to Lawrence Berkeley National Laboratory data through the end of 2023, FTI estimates 402 GW of planned nameplate capacity of solar projects in queue for grid connection for commercial operations between 2026 and 2029, and another 32 GW between 2030 and 2034. Of the total wind and solar projects in queue, FTI estimates 103 GW capacity to be potentially impacted since there will be a 2-to-4-year construction window between the start of construction and placed-in-service dates.

It explains, “We conservatively estimate that more than 320 proposed wind and solar projects with a total capacity of over 100 GW would no longer be economically viable, making it significantly harder, if not impossible, to attract capital and meet key development milestones.”

Its estimates echo similar concerns shared by Wood Mackenzie, which has slashed its 10-year solar forecast to 375 GW AC (see Wood Mackenzie Cuts 10-Year US Solar Outlook By 17%).

FTI cautions that the accelerated phaseout of tax credit eligibility could leave wind and solar investments under development stranded.

Under the OBBBA, wind and solar power projects must either begin construction before July 4, 2026, to achieve safe harbor status, or be placed in service by December 31, 2027, to be eligible for tax credits. At present, FTI analysts do not expect the Treasury Department to retroactively apply safe harbor provisions.

Residential solar ITC, a major driver of solar PV in the country, is set to end after December 31, 2025.

“These provisions disrupt the solar value chain at multiple levels,” states FTI. “This decline would ripple through installer networks, financing platforms and third-party sales channels. At the same time, commercial and utility-scale developers would face a compressed timeline for permitting, interconnection and equipment procurement. Delaying construction beyond July 2026 would mean the loss of full tax credit eligibility.”

Stringent measures are now in place for federal tax credits being barred for companies that secure material assistance from Foreign Entities of Concern (FEOC), unless their projects enter construction before December 31, 2025. This introduces supply chain uncertainty, says FTI.

Making things even more difficult is the Department of the Interior’s heightened scrutiny for all wind and solar power projects. This followed the US President mandating the Department of the Treasury to ensure that there is no artificial use of safe harbor provisions, unless projects are substantially built (see Elevated US Federal Scrutiny For Wind & Solar Energy Projects).

In the current situation, FTI believes developers will need to reassess their profitability and operational strategies for their multi-year projects. They will need to justify continued investments in emerging technologies with the lack of incentives. Moreover, investors may scale back new capital commitments.

Utilities trying to reduce emissions and add cleaner energy would face delays in shifting investments to more conventional project methods. Meanwhile, the removal of planned projects from the development pipeline at a time when energy demand is rising with AI and manufacturing could lead to supply constraints with utilities, resulting in an increase in wholesale power prices.

Speaking at the TaiyangNews Webinar on Global Solar Market Developments 2025, Rystad Energy VP Marius Bakke said US solar deployment is expected to continue despite policy hurdles, as developer pipelines are set and solar remains the cheapest, fastest energy option – though changes to safe harbor rules could disrupt this (see Expect Record Solar Growth In 2025, But Near-Term Risks Loom).