Global VC and private equity funding for the solar sector fell 36% in 2024, says Mercom report

87% of VC funding in 2024 went to solar downstream companies

Public market financing dropped significantly, totaling $3 billion in 2024

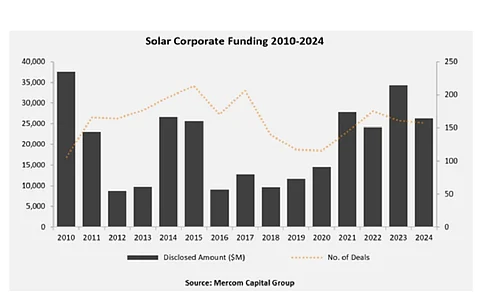

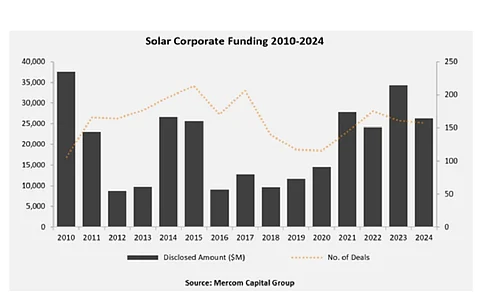

In its recently released Annual and Q4 2024 Solar Funding and M&A Report, global solar PV market intelligence firm, Mercom Capital Group, cited that global corporate funding for the solar sector, including venture capital (VC), public market, and debt financing declined 24% year-over-year (YoY) in 2024, with $26.3 billion raised across 157 deals, compared to $34.4 billion in 161 deals in 2023.

Speaking about the situation, Raj Prabhu, CEO of Mercom Capital Group, said: “2024 was a year of uncertainties for the solar industry, with inflation, high interest rates, trade disputes, and policy ambiguity contributing to declines in funding and M&A activity. The market is awaiting clear policy signals from the new administration on the IRA provisions, ITC extensions, and tariff measures before investors come off the sidelines and deal-making can return to healthier levels.”

Global VC and private equity funding for the solar sector fell 36% in 2024, touching $4.5 billion across 60 deals, down from $7 billion through 70 deals in 2023. Notably, 87% of VC funding in 2024 - amounting to $3.9 billion - went to solar downstream companies.

Key VC-funded companies in 2024 included:

Pine Gate Renewables: $650 million

Nexamp: $520 million

BrightNight: $440 million

Doral Renewables: $400 million

MN8 Energy: $325 million

Others that attracted VC funding were:

Solar PV companies: $401 million

Thin Film companies: $33 million

Service Providers: $1 million

Public market financing dropped significantly, totaling $3 billion in 2024 - 59% lower than the $7.4 billion raised in 2023. While 9 companies went public, raising $1.3 billion, this was a decline from the $2.1 billion raised by 7 companies in 2023

Debt financing remained a vital funding stream, with $18.8 billion raised in 2024 - just 6% lower than $20 billion in 2023. Securitization deals touched a record $5 billion across 16 transactions

M&A activity in the solar sector declined 15% YoY in 2024, with 82 transactions compared to 96 in 2023. The largest transaction involved Brookfield Asset Management and partners, including Brookfield Renewable and Temasek Holdings, acquiring a 53.12% stake in Neoen for $6.54 billion

Solar downstream companies dominated M&A activity, accounting for 66 acquisitions, followed by manufacturers with 6 acquisitions and service providers and Balance Of System (BOS) companies with 5 acquisitions each

Large-scale solar project acquisitions also slowed, with 217 projects acquired in 2024, down from 231 in 2023. The total acquired capacity dropped 17% YoY to 37.7 GW from 45.4 GW in 2023

Project Developers and Independent Power Producers (IPPs) secured 38% of the acquired capacity, followed by Investment Firms and Infrastructure Funds at 35%, and Others at 13%. Others included insurance providers, pension funds, and energy trading companies. The remaining 14% was acquired by Utilities, Oil and Gas companies, and Installers

About 289 companies and investors were included in this report. This report can be found on this link: https://mercomcapital.com/product/annual-and-q4-2024-solar-funding-and-ma-report