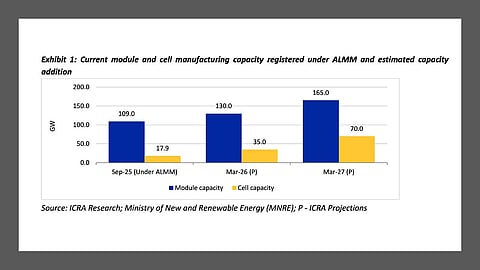

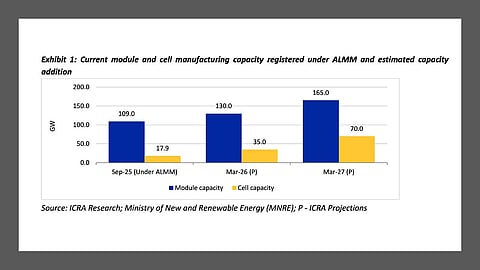

India’s solar PV module capacity is projected to exceed 165 GW by March 2027, up from 109 GW currently, according to ICRA’s estimates

Policy measures like ALMM, PLI, and customs duty are also driving solar cell capacity toward around 100 GW by 2027

ICRA warns of potential overcapacity as domestic demand lags behind growing module production levels

US tariffs and export declines could pressure prices and trigger consolidation among smaller manufacturers

Spurred by strong policy support, India’s solar PV module manufacturing capacity is projected to exceed 165 GW by March 2027 from around 109 GW at present, according to credit rating agency ICRA.

Thanks to the regulatory support, mainly in the form of the Approved List of Models and Manufacturers (ALMM), Basic Customs Duty, and Production Linked Incentive (PLI) schemes, India’s solar cell production capacity is also set to rise from 17.9 GW as listed in ALMM List-II at present to about 100 GW by December 2027. ALMM List-II is set to come into force from June 2026 (see India To Impose ALMM For Solar Cells From June 1, 2026).

Nevertheless, ICRA foresees potential overcapacity in the market as supply outpaces demand. According to analysts, the industry is poised to face a potential overcapacity scenario as the annual solar capacity installation is expected to be 45 GW DC to 50 GW DC against an annual solar module production capacity of 60 GW to 65 GW.

The problem also arises with the US tariffs that have cut exports to one of the largest export destinations for Indian producers, thereby pushing more domestically produced modules into the Indian market.

This may also translate into pricing pressures on domestic OEMs, who will nevertheless benefit in the short term, as ICRA points out that the volume of projects with a September 1, 2025, last date for bid submission that are exempt from using domestically produced cells is around 45 GW to 50 GW. The bidding activity has also slowed down, it added, which ‘remains a key monitorable’.

While vertically integrated manufacturers will benefit in the long run, this situation could lead to consolidation, forcing smaller manufacturers to either exit the market or merge with larger players, according to ICRA.

“The operating profitability for ICRA’s sample set of domestic solar OEMs, which remained elevated at ~25% in FY2025, is likely to moderate due to competitive pressures and overcapacity build-up,” said ICRA’s Vice President & Co-Group Head—Corporate Ratings, Ankit Jain. ICRA defines the sample set as 7 large players that constitute approximately 50% of the total installed module capacity in India.

Jain added, “Given that the ALMM requirement for solar cells is effective from June 2026, a significant scale-up in the cell manufacturing capacity along with its stabilisation in a timely manner remains critical in the near term. Further, the cost of modules using domestic cells is expected to be higher by 3-4 cents/watt compared to the cost of the domestic modules using imported cells.”

Since China dominates the global solar manufacturing supply chain (accounting for over 90% of polysilicon and wafer supply, more than 85% of solar cells, and about 80% of finished modules), ICRA said India’s heavy reliance on the Asian giant makes it vulnerable to any future trade or technology restrictions.

“Moreover, each successive stage in the value chain demands higher technological complexity, which not only requires substantial capital investment but also heightens the risks associated with project stabilisation and implementation,” observes ICRA.

Previously, Wood Mackenzie also raised concerns about overcapacity in the Indian market, forecasting that India’s solar PV module manufacturing capacity would exceed 125 GW by 2025 (see India’s Solar Module Capacity To Exceed 125 GW By 2025).