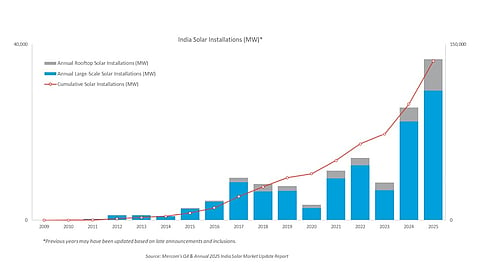

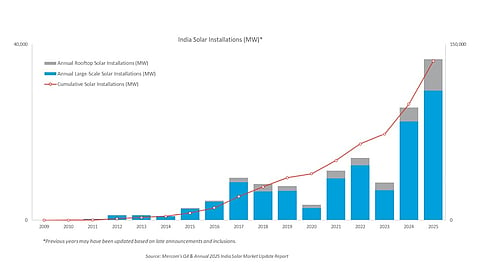

India added 36.6 GW of solar in CY 2025, up 43% YoY, marking the country’s highest-ever annual installation, according to Mercom India Research

About 81% (29.5 GW) of additions came from large-scale projects, while rooftop solar made up just over 19% of new capacity

Open-access projects accounted for 26% of large-scale additions, highlighting growing demand from the C&I segment

Grid curtailment, ALMM-II-related cell supply risks, equipment delays, and a growing PPA backlog could lead to uneven growth in 2026, it forecasts

India’s annual solar installations in calendar year (CY) 2025 hit a record 36.6 GW, up 43% year-on-year (YoY), driven by a supportive regulatory environment, accelerated project execution, and favorable market conditions, according to a new Mercom India Research report.

This helped expand the country’s cumulative installed PV capacity to around 136 GW at the end of December 2025, comprising almost 85% large-scale and 15% rooftop solar facilities.

Mercom says the bulk (81% or 29.5 GW) of the annual additions last year were contributed by large-scale projects, including open-access installations, while rooftop solar accounted for more than 19% of the total mix. Open access facilities alone accounted for 26% of the large-scale additions, highlighting the growing demand from the commercial and industrial (C&I) segment.

The trio of Rajasthan (34%), Gujarat (28%), and Maharashtra (15%) led large-scale installations last year.

The last quarter of CY 2025 contributed 9.9 GW of new PV capacity, up nearly 11% sequentially and about 21% annually. It, however, was not as high as 11.3 GW, which the country installed in Q2 2025 (Q1 2025: 6.7 GW) (see India Adds 18 GW Solar PV Capacity In H1 2025).

Q4 2025 additions included 7.6 GW of large-scale capacity that improved by 12% quarter-on-quarter (QoQ).

Solar also added the largest chunk of new power capacity in 2025, with its 57 GW accounting for 68% of all the additions the country recorded last year, according to Mercom.

Despite this strong growth, Mercom highlights some pain points, calling curtailment as the ‘most pressing issue’, especially in solar-heavy states.

“At the same time, the upcoming Approved List of Models and Manufacturers (ALMM)-II deadline is creating uncertainty around cell availability, raising the risk of short-term supply bottlenecks,” stated Mercom Capital Group CEO Raj Prabhu. “Equipment delays and a growing PPA backlog are also weighing on the market. Unless transmission expansion and manufacturing scale move in sync with capacity additions, growth will remain uneven in 2026.”

The complete Mercom report, titled Q4 and Annual 2025 India Solar Market Update Report, can be purchased on its website.

Mercom’s annual capacity addition statistics are slightly lower than the 37.9 GW JMK Research & Analytics earlier reported for 2025 (see India Installed Close To 38 GW Solar PV Capacity In 2025).

Meanwhile, the Ministry of New and Renewable Energy (MNRE) has reported 4.8 GW of new solar power capacity additions in January 2026. This expands India’s cumulative installed solar power capacity as of January 31, 2026, to 140.6 GW.