JMK Research says India awarded close to 4.45 GW renewables capacity in initial 2 weeks of April 2023; SJVN picks BVG India for 100 MW solar project; ReNew has raised $400 million through subsidiary.

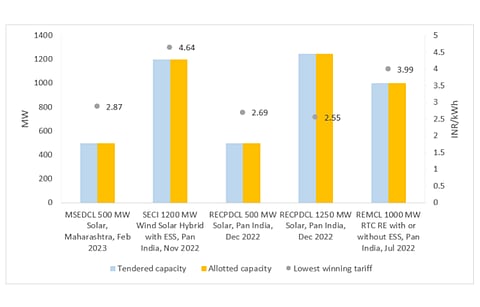

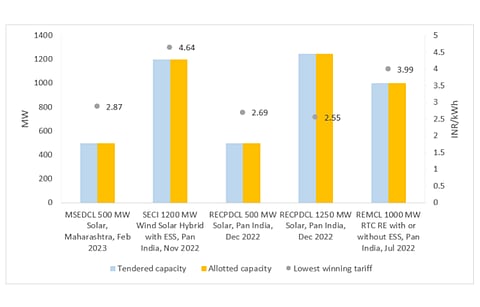

Auction activity picking up in India: JMK Research & Analytics says in the first 2 weeks of FY2024 or April 2023, India has already allotted around 4.45 GW of utility scale tenders, including 3 vanilla solar tenders, 1 wind-solar hybrid with energy storage and 1 round-the-clock (RTC) tender. For vanilla solar tenders, the lowest tariff was discovered as INR 2.25/kWh for 1.25 GW capacity. For SECI's 1.2 GW hybrid tender, the discovered tariff was 'unusually' high at INR 4.64/kWh, followed by REMCL's RTC tender for 1 GW capacity was discovered as INR 3.99/kWh. Maximum capacity was won by ReNew with 1.2 GW in 3 of the 5 tenders. The market intelligence firm identifies NTPC REL, Avaada, ACME and Ayana Renewables as the other active players.

BVG bags SJVN project: SJVN Limited's wholly owned subsidiary SJVN Green Energy Limited has awarded its 1st balance of system (BOS) contract, to BVG India Limited for a 100 MW solar project in Punjab. The contract is worth INR 1.33 billion ($16.13 million) and includes operation and maintenance (O&M) for 3 years. Tentative cost of the project is INR 5.45 billion ($66.1 million). On completion, it is expected to generate 227 million units in the 1st year and over the course of its working life of 25 years, it will generate around 5,302 million units. SJVN won the project for the winning tariff of INR 2.65 ($0.032)/kWh. The project is contracted to sell power to Punjab State Power Corporation Limited (PSPCL) under a power purchase agreement (PPA) with SJVN.

ReNew raises $400 million: ReNew Energy Global Plc has raised $400 million through its subsidiary and Mauritian entity Diamond II Ltd. According to local daily The Economic Times, the company claims it to be the 1st high-yield bond issue to come out of India in more than a year. It priced the bond issue at 8.15% lower than the initial guidance of 8.50% citing strong investor interest which added up to $1.5 billion. ReNew plans to use the capital to refinance its secured overnight financing rate (SOFR) linked loans.