India could become a full-scale solar GW manufacturer by 2030, with module, cell, wafer, and polysilicon production expanding rapidly, according to a new TERI report

Wafer/ingot production is only 2 GW, with no polysilicon plants yet, and over 90% of solar manufacturing tools are currently imported, mainly from China

TERI suggests bringing in PLI for manufacturing equipment, and viability gap funding for low-carbon polysilicon projects to signal market intent

To meet 2030 targets, India should look into establishing Solar Semicon Technology Parks, a dedicated Skill Council, and circular manufacturing systems

India could move from being a GW-buyer of solar equipment to a full-scale GW-maker across the solar value chain by 2030, according to a new report from The Energy and Resources Institute (TERI). The report says this shift will depend on stronger upstream integration, domestic equipment production, better financing tools, and the development of skilled workers and ESG standards.

Globally, the solar PV manufacturing market is currently dominated by China, with more than 80% of capacity concentrated there. India offers potential as a worthy competitor thanks to its supportive regulatory environment, supportive policies such as Production Linked Incentives (PLI), high import tariffs on finished panels, and the Approved List of Models and Manufacturers (ALMM).

However, despite investment flowing in, mismatched timelines and absent equipment-specific support threaten the country’s upstream progress.

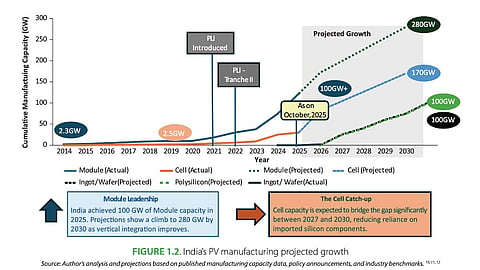

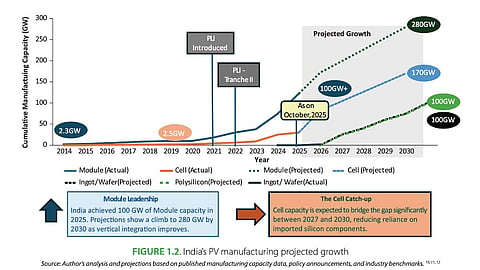

The country has been able to establish around 120 GW of annual module production capacity (growing from 2.3 GW in 2024), outpacing its current annual demand of 54 GW DC. Its cell production capacity has increased to around 30 GW (from 2.5 GW in 2019). By 2030, this capacity is projected to grow to 280 GW and 170 GW, respectively.

Further upstream, production lags behind, as ingot/wafer capacity stands at only 2 GW, while there is no operational polysilicon capacity in the country.

What’s more, more than 90% of upstream tools like Siemens reactors, ingot furnaces, diamond-wire saws, and PECVD/ALD systems are imported, with Chinese firms controlling module assembly lines, highlighting a major upstream vulnerability for this market. “This reliance amplifies foreign exchange risks, supply disruptions, and geopolitical tensions, especially in capital-heavy stages. Without targeted incentives and R&D, toolchains will remain the sector's silent saboteur,” state the analysts.

India must launch a PLI scheme for solar manufacturing equipment to reduce its reliance on imported factory equipment, the writers stress.

TERI backs extending the ALMM further upstream to signal market intent, extending it to wafers and polysilicon between 2028 and 2030, while retaining it for modules and making it compulsory for cells by 2026. The government must apply cell and upstream ALMM mainly to government and related projects through an annual quota, while allowing private competitive projects to continue buying the cheapest available modules until domestic supply catches up with projected demand.

The report urges the government to provide viability gap funding to low-carbon polysilicon projects so they can compete with cheaper, more polluting overseas producers.

TERI Director General Dr. Vibha Dhawan says the real strategic inflection lies upstream in the capacity to manufacture cells, ingots/wafers, and polysilicon at scale with competitive costs and high quality.

“Strengthening domestic PV manufacturing is not merely an industrial objective but an imperative for economic growth; it is central to our energy security, our ability to meet climate commitments, and our ambition to drive a green industrial revolution,” said Dhawan.

Currently, most investments are concentrated in Gujarat, Tamil Nadu, Karnataka, Maharashtra, and Rajasthan. To achieve the projected production capacities by 2030, the country will need to develop skilled manpower alongside developing a manufacturing ecosystem, including circularity.

Analysts recommend establishing Solar Semicon Technology Parks with open-access pilot lines for TOPCon, HJT, and tandems run by industry-research consortia. To address the talent gap, they also recommend creating a dedicated Skill Council and targeting 30% women workforce by 2030.

The complete report, titled India’s PV Manufacturing & Its Strategic Inflection Points, is available for free download on TERI’s website.

TaiyangNews is bringing together the Indian solar PV manufacturing industry for the Solar Technology Conference India 2026 (STC.I 2026). To be held on February 5 and 6 in Aerocity, New Delhi, this 2nd edition of the TaiyangNews physical conference will also have banks, investors, and policymakers in attendance. TERI Director Er. Alekhya Datta will also speak at the event. Register for the event here.