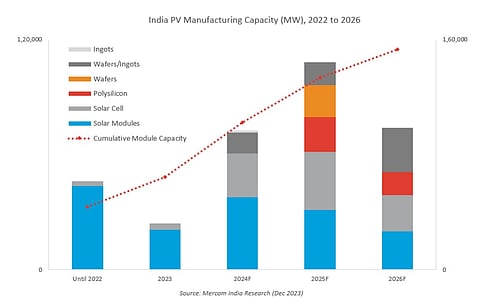

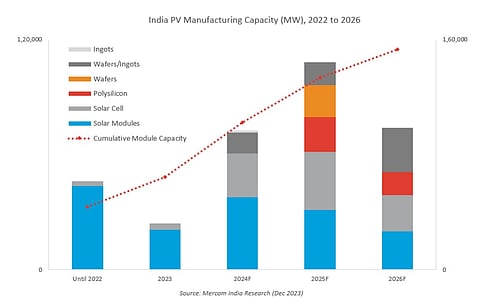

By 2026, India's solar PV module manufacturing capacity is expected to surpass 150 GW, and solar cell capacity 75 GW, according to Mercom India Research's new report.

It claims at the end of 2023, the country's total solar module and cell production capacity grew to 64.5 GW and 5.8 GW, respectively.

Of the total capacity, India added 20.8 GW solar module and 3.2 GW cell manufacturing in CY 2023. A majority or 60% of this is equipped to roll out modules in M10 and G12 wafer sizes as is the trend internationally now, says Mercom in its report titled State of Solar PV Manufacturing in India 2024.

However, it does not see any further vertical integration happening till 2024. Wafer/ingot, wafers and polysilicon capacity is expected to come online only in 2025.

In terms of technology, it is the monocrystalline modules that make up 67.5% of the cumulative production capacity. Polycrystalline modules occupy a 15.1% market share, followed by 12.3% TOPCon and 5.1% thin-film.

Monocrystalline is expected to continue its dominance going forward, accounting for 59.7% of the annual module and 50.5% annual cell production capacity by 2026-end.

Prime Minister Narendra Modi's home state Gujarat hosts 46.1% solar module production capacity, for which the report attributes its favorable policies, investor incentives, and demand from its neighboring states. The state next in line is Rajasthan with only 9.3% of this capacity, followed by Tamil Nadu's 7.6% share.

In terms of solar cell capacity, Telangana has 39% annual capacity, followed by 34.7% in Gujarat and 13.9% in Himachal Pradesh.

Among other reasons responsible for this significant annual growth is existing demand. Mercom analysts count close to 97.5 GW of large-scale projects in development pipeline between 2024 and 2026.

The recently announced PM Surya Ghar Program with a target to install solar panels on 10 million homes is another booster dose to produce solar panels locally. It is expected to need 30 GW rooftop PV capacity (see India Eyeing 30 GW Rooftop Solar Capacity With New Scheme).

The planned reimposition of the Approved List of Models and Manufacturers (ALMM) List I from April 1, 2024 will further strengthen demand for domestically-produced solar cells and modules (see India Set To Bring Back ALMM Requirement By April 2024).

However, Mercom points out that only 22.2 GW of module manufacturing capacity is listed in the ALMM. "This suggests that a large part of the installed capacity cannot be supplied to projects that are mandated to use modules listed under ALMM," explains Mercom India's Managing Director Priya Sanjay.

Indian solar PV manufacturing is also growing in response to rising demand from export markets like the US where Chinese modules are not easy to land, and potential markets in Europe and Africa, according to the report. Indian cell imports in CY 2023 rose 169% annually to 15.6 GW, whereas its exports grew by 2,765% from 10 MW in 2022 to 286.3 MW in 2023.

"One of the main challenges for developers with locally made solar modules is the ability to procure larger quantities of latest technology modules at a given time. Most manufacturers can only deliver the module capacities in a staggered manner," points out Sanjay. "With the increase in the manufacturing capacity challenge of bulk delivery of modules will be addressed."

Nonetheless, the report writers argue that the Indian manufacturers continue to face challenges from the competitively-priced Chinese products.

The complete report can be purchased from Mercom's website.

In an April 2023 report, JMK and IEEFA forecast India's nameplate solar panel manufacturing capacity to grow to 110 GW by FY 2026 (see India Could Compete With Chinese PV In Next 3 Years).