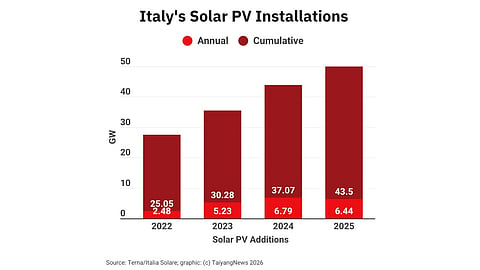

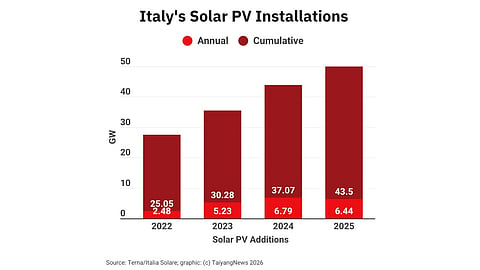

Italy added 6.44 GW of solar PV in 2025, down 5% YoY from 6.8 GW in 2024, according to Italia Solare

The decline was driven by slower residential and C&I installations on an annual basis

Utility-scale solar grew 15% YoY to 3.41 GW, supported by previously issued permits

Italy’s cumulative solar capacity reached 43.5 GW by end-2025, with nearly 70% in distributed segments

Italia Solare expects higher utility-scale additions in 2026 following recent FER-X auction results

A slowdown in the distributed solar segment pulled down Italy’s annual solar PV installations in 2025 by 5% year-on-year (YoY) to 6.437 GW, according to industry body Italia Solare. This compares to 6.8 GW that the country deployed in 2024 (see Italy Installed 6.8 GW New Solar PV Capacity In 2024).

Both residential and commercial & industrial (C&I) segments contributed to the annual drop, partially offset by a 15% YoY increase in large-scale solar installations last year, according to Italia Solare’s evaluation of the data released by Italian grid operator Terna.

With the elimination of the Superbonus subsidy scheme for the sector (under 20 kW system size), the residential segment appears to have stabilized around an average of 300 MW/quarter, down 24% YoY. The number of installations also dropped from 274,537 in 2024 to 198,667 in 2025.

The C&I segment (20 kW to 1 MW) declined 21% YoY to 1.744 GW. Contraction in this segment was particularly pronounced in 9M 2025, before recovering in Q4. Italia Solare notes that this decline could be driven by various tender announcements that may have prompted companies to wait for certainty and funding before proceeding with construction.

“We encourage the government to implement financial support policies for families and businesses, especially facilitating access to credit,” said Italia Solare President Paolo Rocco Viscontini. “Indeed, photovoltaic is worthwhile, even without incentives for businesses and with the ever-required 50% tax deduction for residential projects, but what's needed is to help families and businesses advance the cost of photovoltaic systems.”

Partially offsetting the slowdown was the utility-scale segment, where more than 1 MW of installations made for a 15% annual growth. Against installations of 2.91 GW in 2024, this segment deployed 3.412 GW in 2025, with the association attributing the increase to numerous authorizations issued in recent years. Projects with over 10 MW installed capacity alone added 1.03 GW in Q4, exceeding the total of 688 MW deployed in the initial 3 quarters of last year.

In fact, nearly 2.4 GW of utility-scale capacity came online in Q4 2025 out of a total 6.4 GW of installations.

At the end of 2025, Italy’s cumulative solar installations reached 43.5 GW, distributed between 11.6 GW (27%) of residential and 18.85 GW (43%) of C&I capacity. The remaining 13.04 GW (30%) was large-scale solar.

In 2026, the association expects more large-scale solar systems to come online following FER-X auction results announced in December 2025 (see Italy Awards 1.1 GW Solar PV Under 2nd FER-X Auction).