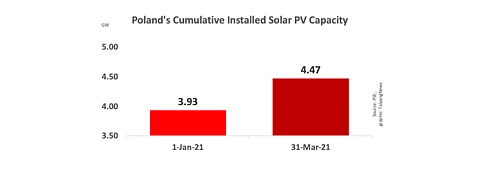

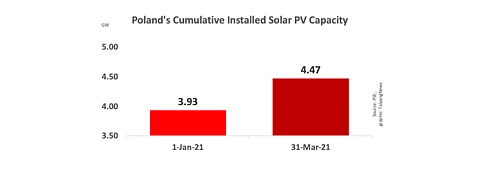

At the end of March 2021, Poland's cumulative installed grid connected solar PV capacity grew to 4,469.8 MW, according to the country's grid operator Polskie Sieci Elektroenergetyczne (PSE).

While PSE doesn't reveal more than this, it had earlier announced that till January 1, 2021, Poland had an installed solar PV capacity of over 3.93 GW, mainly led by the proliferation of small scale solar in the country (see Poland's Cumulative Installed PV Capacity Exceeds 3.9 GW).

Do the math, and it shows within Q1/2021, the European nation added 534 MW of new PV capacity to the grid. The Institute of Renewable Energy (Instytut Energetyki Odnawialnej, IEO) had previously forecast aggregate capacity reaching 6 GW by the end of 2021, growing up to 8 GW by 2022-end, and reaching 15 GW by 2025 (see Poland: Solar PV Capacity To Grow To 15 GW By 2025).

In its recently released report Photovoltaic Market in Poland 2021, IEO sees the market continuing to grow with large scale solar projects also contributing to the annual growth. In 2021, the market analysts also see a minimum of 200 MW coming online through business prosumers, for the 1st time, a trend that's likely to gain traction over the coming years.

Referring to the challenge of rising prices of imported equipment as well as the risk of supply disruptions in the PV supply chain, the report writers suggest the risk can be mitigated by regulatory incentives and the creation of an active industrial policy to promote local and European content use.

"The share of domestic producers in the supply of components and devices for photovoltaic installations in 2020 was 23%, but in 2025, according to the investment plans of Polish industrial companies, it may increase to almost 40%," stated IEO.