EU solar jobs rose 5% to 865,000 in 2024, but SPE expects a 5% contraction in 2025

Deployment remains dominant in EU solar employment, though O&M and recycling jobs are likely to steadily increase

Germany leads EU solar employment, while Italy is projected to surpass Spain by 2029

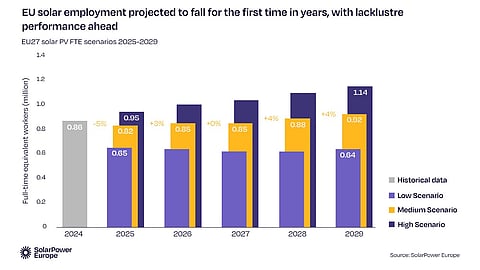

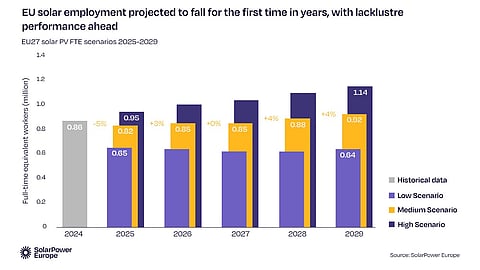

Jobs in the European Union’s (EU) solar sector rose by 5% year-on-year (YoY) in 2024, reaching a record 865,000 positions. However, SolarPower Europe (SPE) warns that slower PV market growth and manufacturing challenges could reduce the workforce by an equal percentage in 2025, for the 1st time in a decade, to about 825,000.

In its annual EU Solar Jobs Report 2025, SPE says that solar employment in the European solar sector mirrors broader market trends. Actual installed capacity exceeded expectations to settle at 65.1 GW in 2024, making it the 4th consecutive year of record-setting installations. This led to a 5% increase in full-time equivalent jobs in the sector, exceeding SPE’s 4.2% forecast.

Germany was the largest solar employer in the EU with 128,000 solar jobs. Spain and Italy were in the 2nd and 3rd positions, followed by Poland, France, Romania, and Hungary to form the top 7 nations on the SPE list. The report states that Italy, with its steady market growth and greater focus on utility-scale solar, is likely to overtake Spain by 2029.

SPE projects jobs to contract by 5% in 2025, reflecting the expected slowdown in the pace of installations this year. The association guides for a 1.5% annual decline in EU solar installations, totaling 64.2 GW by the end of the year (see SolarPower Europe: European Union To Install 64.2 GW PV In 2025).

SPE sees the expected slowdown as resulting from a weakening residential rooftop solar segment, even as the impacts of the energy crisis ease, the lack of system flexibility, and continued challenges for EU-based solar manufacturing. However, it expects the slowdown to be temporary. The rooftop solar segment workforce has been shrinking for the last 3 years, from 73% in 2022 to 59% in 2024, and further to 56% by 2029.

In 2024, solar manufacturing accounted for 40,902 jobs, while operations and maintenance (O&M) jobs were higher at 66,393. Decommissioning and recycling accounted for 13,925 jobs.

However, deployment continues to be the backbone of EU solar jobs, accounting for an 86% share last year, and is expected to gradually drop to 80% by 2029 as market growth levels off, according to SPE. Over the same period, O&M jobs are expected to rise from 8% to 12%, while decommissioning and recycling would double from 1.6% to 2.9%.

Manufacturing jobs will remain stable at around 5% even though it was projected to reach 9% of total employment. Report writers claim, “This shift underscores the weakening prospects for EU-based solar manufacturing.”

Nevertheless, in its medium-term outlook SPE expects recovery from 2026 onward with total employment reaching more than 916,000 jobs by 2029. SPE has now revised its EU solar jobs projection from last year to achieve the milestone of 1 million after 2030, from 2027 as forecast earlier.

“In 2025, solar delivers 825,000 quality jobs for Europe. That is incredible. However, this falls short of the 1 million solar job mark we were hoping to reach by now, and for the first time in a decade, solar jobs growth has halted,” said SPE CEO Walburga Hemetsberger. “We can’t ignore this warning. EU leaders have the opportunity to reverse course, stabilise the market, support EU solar manufacturers, and strengthen its skills strategy.”

Michael Schmela, SPE’s Executive Advisor and Director of Market Intelligence, adds, “This report therefore outlines clear policy recommendations: from establishing a European Solar Skills Intelligence Hub, to securing stable and accessible funding for training, boosting vocational pathways and ensuring inclusive access to solar careers. If the European Union wants to continue to bank on solar power as the cornerstone of its competitiveness, energy security, and sustainability, now is the time to act.”

The complete report can be downloaded for free from SPE’s website.