Stonepeak has launched WahajPeak, its first renewable energy platform in the Middle East

WahajPeak will invest in large-scale solar, wind, and battery storage projects across GCC and the region

Former Jinko Power VP Mothana Qteishat, with a 17-year track record in RE, will lead this Stonepeak platform as CEO

Stonepeak, a US-based alternative investment firm, has launched WahajPeak, its first renewable energy platform in the Middle East. Through this platform, it aims to harness the region’s growing market while supporting high-quality renewable projects locally and abroad.

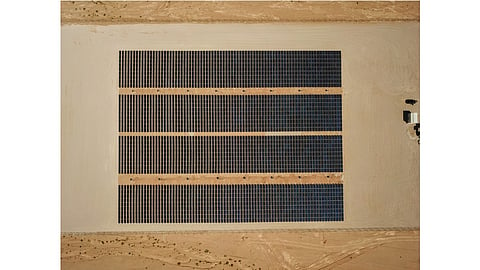

WahajPeak will invest in utility-scale solar, wind, and battery storage projects across the Gulf Cooperation Council (GCC) and the broader Middle East. Stonepeak says its investment is based on supportive policy tailwinds across the region as countries here promote decarbonization, energy diversification, and grid modernization.

WahajPeak will be led by the former Vice President of Jinko Power, CEO Mothana Qteishat, who has 17 years of experience in the region’s renewable energy sector.

“Governments across the Middle East and North Africa are targeting the deployment of approximately 175 GW of renewable energy capacity by 2030, creating a rapidly growing need for reliable, utility-scale infrastructure,” said Qteishat.

Rystad Energy’s 2024 research forecast the Middle East to account for more than 100 GW of installed solar PV capacity by 2030, up from over 16 GW at the end of 2023, led by Saudi Arabia, Oman, and the UAE (see ‘Oil & Gas Powerhouse’ Encouraging Rapid Increase Of RE).

Goldman Sachs expects Saudi Arabia alone to invest $235 billion in clean energy by 2030, driven by solar (see Saudi Arabia Expected To Invest $235 Billion CapEx In Clean Energy By 2030).

Qteishat added, “We’ve designed WahajPeak to scale and adapt over time, in step with the region’s evolving energy landscape, and we are excited to work closely with our stakeholders to seize the significant opportunities ahead.”

Anticipating growing demand for solar energy in the Middle East, several companies – mainly Chinese – have announced investments in establishing several GWs worth of solar manufacturing factories here, spread across the entire supply chain (see China’s Almaden Plans 500,000 Ton Solar Glass Plant In UAE).