With technical and financial support of the World Bank, Vietnam is planning to launch tenders for 1 GW of solar PV capacity in the form of two separate pilot tenders with 500 MW capacity each for substation-based bidding and ground-mounted solar parks. Both pilot tenders are being planned in 2020. The bank has recommended holding a pilot auction for 200 MW of floating solar PV capacity as well for the year 2020-21.

As the name suggests, substation-based bidding will award capacity based on available capacity at electrical substations.

The bank is supporting Vietnam in effectively deploying solar power capacity across the country to enable it to meet its Nationally Determined Contribution (NDC) of its Paris Climate targets and reduce its need for new coal generation, as it transitions towards competitive solar auctions.

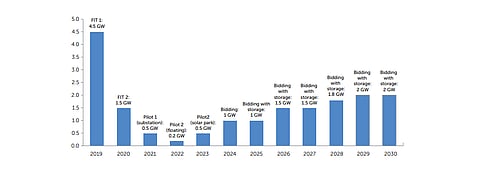

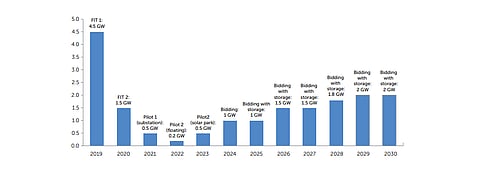

For this, the World Bank has prepared a new report titled Vietnam Solar Competitive Bidding Strategy and Framework that claims new approaches to bidding and deployment of solar projects can boost the country's solar generation capacity from the current 4.5 GW to 18 GW by 2030, as against the country's current target of 12 GW by the same year. This target revision is under consideration of the Power Development Plan (PDP) 8 for the period of 2021-2030 and is expected to be published early 2020.

Of this proposed 18 GW, according to the report 4.5 GW has been already installed backed by the country's feed-in-tariff (FIT) 1 policy, and another 1.5 GW is likely to be added under FIT 2. The other 12 GW can be contracted through substation based bidding and bidding for solar parks (comprising ground mounted and floating PV capacity) till 2030. Post 2025, once battery storage prices drop by another 20% to 30%, tenders could club solar PV with storage.

Such a system, the bank believes, will ease curtailment issues that solar power currently faces in the country as its installed capacity rose spectacularly under the attractive FIT scheme, but grid infrastructure isn't ready to accommodate all of it 24/7. This scheme could also be replicated for other renewable energy technologies in the future.

Timeline

At the same time, the report recommends the country to set annual and medium-term solar deployment targets with clear timelines – 12 months, 18 months or 24 months – to show the private sector that solar is a reliable long-term potential investment in Vietnam, along with revising legal framework to cover competitive selection of independent power producers (IPP).

Jobs

Expansion of solar power generation will create an estimated 25,000 new jobs in project development and O&M segment annually through 2030, as per the report's estimates, and another 20,000 in manufacturing if Vietnam maintains its current share of global solar equipment market.

The report is supported by the bank's Energy Sector Management Assistance Program (ESMAP) and the Global Infrastructure Facility (GIF) that approved $1.5 million funding to enable the World Bank to help Vietnam prepare a solar competitive auction pilot program (see World Bank Secures GIF Support For Vietnam Solar Pilot).

Recently, international law firm Baker McKenzie said Vietnam is contemplating up to 1 GW renewable energy supply to private sector under corporate PPA pilot (see Vietnam Mulling Pilot For Corporate Power Purchasers).